– Jessica Sampson, Agricultural Economist, Livestock Marketing Information Center

As the summer season winds down, cattle producers must start making “keep or cull” decisions in their cow herds. Cull cows come to market throughout the year, but prices are seasonally lowest in the fall. This is when supply of cull cows to the market is the largest, as many U.S. cow-calf producers sell animals they do not wish to retain in the herd, before having to feed them over winter. When cull cows are sold into the beef supply, the main product produced by them will be 90 percent lean ground beef. This is blended with 50 percent lean trimmings from fed steers and heifers to produce varying degrees of lean to fat hamburger and ground beef mixes. The dairy industry does play a role in the cull cow market, however their supply is much more consistent over the year, especially this year due to little change in the national dairy cow inventory.

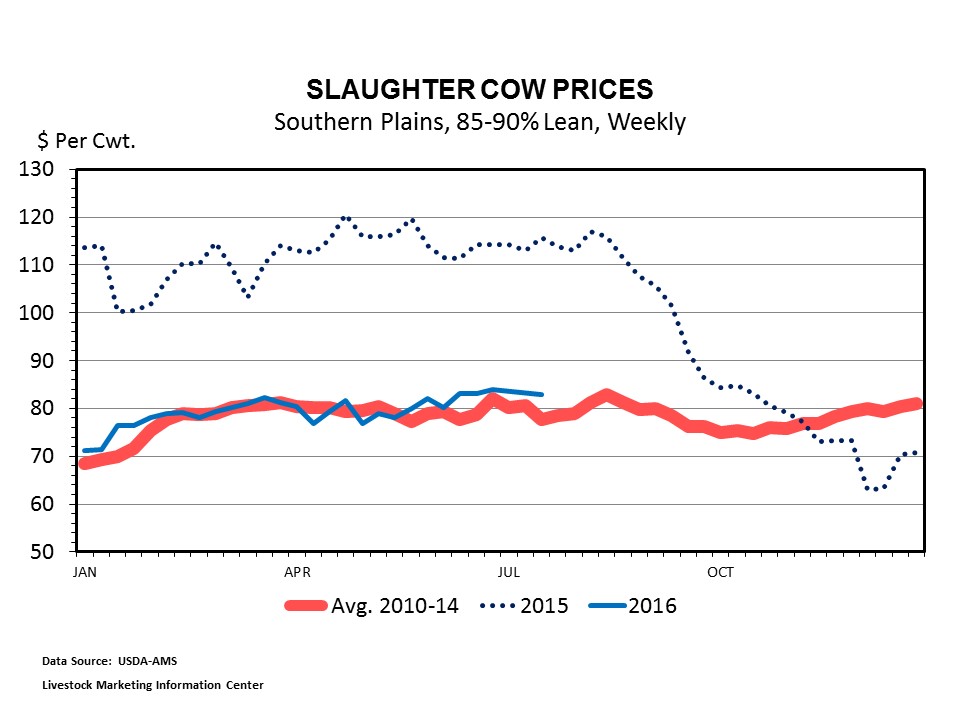

Looking back on the past two years, beef herd inventory growth significantly decreased the supply of cull cows on the market. Cull cow prices in 2014 and the first half of 2015 reflected this tightened supply by trending up to record levels. The market dropped off significantly in August of 2015, but this was true across all sectors in the cattle industry.

For the first half of 2016, cull cow slaughter tracked 8 percent above the first half of 2015. This year-over-year increase was generally expected, if nothing else for the fact that older cows held back an extra year will only have a certain number of calving seasons left in them. Another way to put it is, so far this year the industry has returned to a more normal “culling rate.” From 2008 to 2013, the years surrounding the drought and cattle liquidation, the annual cow cull rate was between 10 percent and 12 percent of the January 1 national beef cow count. In 2014, that cull rate was 9 percent and in 2015 it was 8 percent. Looking forward to what we can expect cull cow slaughter to total for 2016; historically, beef cow slaughter increases about 4 percent in the second half of the year compared to the first half. Using this simple average, beef cow slaughter in 2016 can be expected to total around 10 percent above 2015, to 2.5 million head. That would calculate to an 8.5 percent culling rate for 2016.

Due to the increased supply of cull cows on the market, lower cull cow prices have been experienced so far. This year we have seen, and expect to continue seeing more normal price and supply seasonality in the cull cow market. According to the past five year average (2010-2014), cull cow prices have dropped 6 percent on average from the beginning of September to mid-October. From mid-October to end of December, prices have historically increased about 8 percent on average.

In mid-July, cull cow prices in the Southern Plains were around $83 per cwt. live weight according to USDA’s Agricultural Marketing Service. Assuming these prices stay fairly consistent until September (and using the historical price relationships described above), October prices could be around the mid $70s per cwt. and end of December prices could be around the low $80s per cwt. This pencils out to an additional $80 to $100 per cow sold by September or during the end of December as opposed to sold in October.

Several factors are supporting seasonally consistent price and supply relationships in the cull cow market through 2016. Included in these factors is the decrease in imported beef from Australia into the U.S., so far in 2016. Beef imported from Australia is generally the 90 percent lean ground beef used in manufactured food items, so it competes rather directly with domestic cull cow beef product. The decrease in Australian beef has led to an increase in demand for the U.S. 90 percent lean beef, and lends support to cull cow prices. Another factor includes a generally increased supply of cull cows based on larger cattle inventory levels and an assumed slow-down in cow and heifer retention due to consistently lower cattle prices.

Based on historical seasonal relationships, there is a strong possibility of receiving a higher price for cull cows before and after October. We expect more normal type of seasonality in cull cow prices to continue in 2017. Compared to the possible low to mid $70s prices in October, March prices may increase up to the low $80s. If holding cull cows into 2017, key costs need to be penciled out, such as additional costs of feeding the cow if she needs to be pulled off pasture before taking her to auction. Hay prices are expected to continue trending lower this year, and there should be ample supply of hay going into winter. However, as always there are no guarantees in these markets. These price and supply estimates and forecasts are based on general relationships, and each producer must pencil the benefits and costs they incur between the decisions of keeping, holding, or culling a beef cow.