Night 2 – “Farm Economic Outlook”

Ben Brown, Senior Research Associate

Food and Agricultural Policy Research Institute

University of Missouri

Source: Farmdoc, University of Illinois

DTN Farm Business Editor Katie Micik Dehlinger reported yesterday that, “The retail prices of all eight major fertilizers climbed higher in the second week of October, with anhydrous, MAP and UAN32 posting the largest gains.

“DTN polls retail fertilizer sellers each week to compile price estimates and considers a price change of 5% or more to be significant.

“Anhydrous prices climbed 16% on average to $804 per ton. MAP and UAN32 each climbed by 7% to $794/ton and $418/ton, respectively.”

Dehlinger explained that, “The prices of the remaining five fertilizers were all higher than last month, but less significantly. DAP cost an average of $711/ton; potash, $506/ton; urea, $575; 10-34-0, $613/ton; and UAN28, $356/ton.”

Source: James Mintert and Michael Langemeier, Purdue Center for Commercial Agriculture

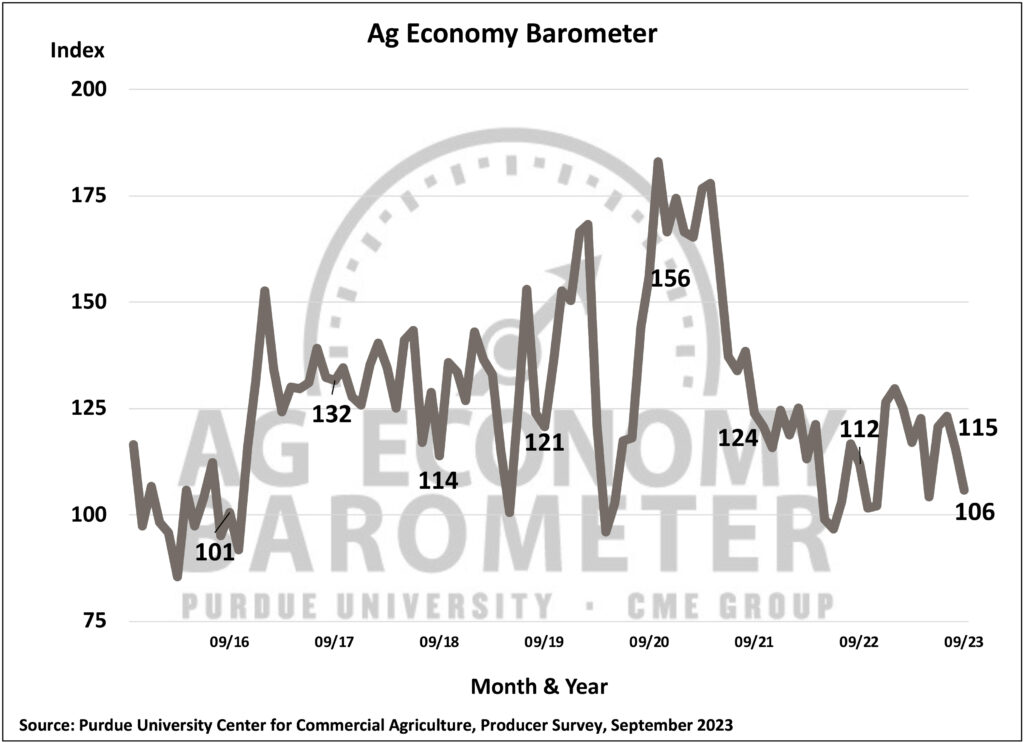

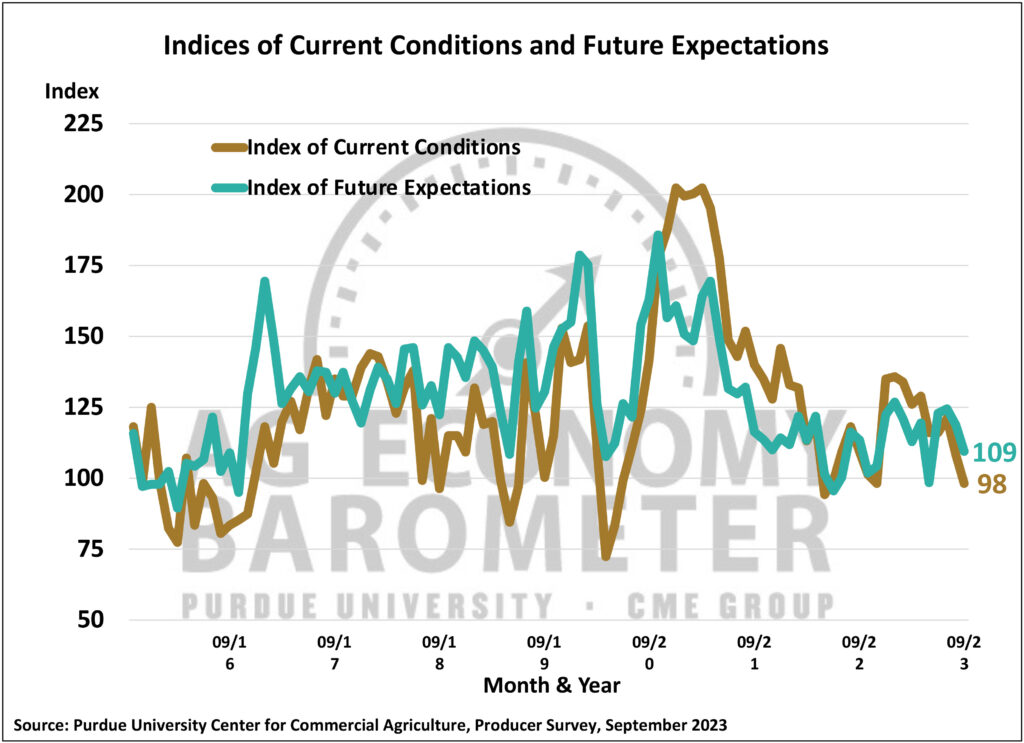

Agricultural producers’ sentiment declined for the second month in a row during September as the Purdue University-CME Group Ag Economy Barometer fell 9 points to a reading of 106. Producers expressed concern about both their current situation as well as future prospects for their farms. The Current Conditions and Futures Expectations Indices both declined 10 points in September leaving the Current Conditions Index at a reading of 98 while the Future Expectations Index stood at 109. Weakening prices for major crops and ongoing concerns about high production costs and interest rates weighed on producers’ minds this month. September’s declines left all three indices below year-ago levels. This month’s Ag Economy Barometer survey was conducted from September 11-15, 2023.

Source: James Mintert and Michael Langemeier, Purdue Center for Commercial Agriculture

U.S. farmers’ sentiment weakened in August compared to July as the Purdue University-CME Group Ag Economy Barometer dipped 8 points to a reading of 115. This month’s decline was fueled by producers’ weaker perception of current conditions both on their farms and in U.S. agriculture as the Current Conditions Index fell 13 points to a reading of 108. The Future Expectations Index also declined in August to a reading of 119, 5 points below a month earlier. This month’s Ag Economy Barometer survey was conducted from August 14-18, 2023. Although producer sentiment weakened in August, producers’ rating of farm financial conditions changed little this month, as the Farm Financial Performance Index declined just one point to a reading of 86. However, producers’ perspectives on farm financial conditions were noticeably weaker than a year earlier when the index stood at 99. Weaker producer sentiment this month did translate into a decline in the Farm Capital Investment Index. The investment index fell to 37, eight points lower than in July and two points lower than a year earlier. Among producers with a negative view of the investment climate, the increase in prices for farm machinery and new construction along with rising interest rates were the two most commonly cited reasons for their negative view. In a related question, over half (60%) of producers in this month’s survey said they expect interest rates to rise in the upcoming year.

When asked about top concerns for their farming operations in the next 12 months, producers continue to point to higher input prices and rising interest rates as their top two concerns. Higher input prices was chosen by one out of three (34%) and rising interest rates was chosen by one out of four (24%) survey respondents as a top concern. Even though crop prices weakened significantly this summer, producers ranked declining commodity prices as their number three concern, chosen by one out of five (20%) producers.

Click here to download the full report

Source: Peggy Hall, OSU Extension

Is a tree service business considered “agriculture” for purposes of Ohio rural zoning?

No, tree trimming and tree cutting activities are not listed in the definition of agriculture in Ohio’s rural zoning laws, although the definition does include the growing of timber and ornamental trees. The definition ties to the “agricultural exemption” and activities that are in the “agriculture” definition can be exempt from county and township zoning. Here is the definition, from Ohio Revised Code sections 303.01 and 519.01:

“agriculture” includes farming; ranching; algaculture meaning the farming of algae; aquaculture; apiculture; horticulture; viticulture; animal husbandry, including, but not limited to, the care and raising of livestock, equine, and fur-bearing animals; poultry husbandry and the production of poultry and poultry products; dairy production; the production of field crops, tobacco, fruits, vegetables, nursery stock, ornamental shrubs, ornamental trees, flowers, sod, or mushrooms; timber; pasturage; any combination of the foregoing; and the processing, drying, storage, and marketing of agricultural products when those activities are conducted in conjunction with, but are secondary to, such husbandry or production.

What are the benefits of being enrolled in the “agricultural district program” in Ohio, and is there a penalty for withdrawing from the program?

There are three benefits to enrolling farmland in the agricultural district program:

Continue reading The Ag Law Roundup: your legal questions answered

By: Peggy Kirk Hall, Attorney and Director, Agricultural & Resource Law Program

A long process to update Ohio’s regulations for solar energy facility development has nearly reached its end. On July 20, the Ohio Power Siting Board (OPSB) adopted new rules that include revisions to rules that apply to solar facilities under its jurisdiction—those that have a nameplate capacity of 50 megawatts or more. The rules will next go to the Ohio legislature’s Joint Committee on Agency Rule Review (JCARR) for a final review before they can become effective.

A long process to update Ohio’s regulations for solar energy facility development has nearly reached its end. On July 20, the Ohio Power Siting Board (OPSB) adopted new rules that include revisions to rules that apply to solar facilities under its jurisdiction—those that have a nameplate capacity of 50 megawatts or more. The rules will next go to the Ohio legislature’s Joint Committee on Agency Rule Review (JCARR) for a final review before they can become effective.

The OPSB began the rules review in 2020. The process included stakeholder meetings, public workshops, a draft proposal of revisions, and a review of comments to the draft rules. Many parties and interested individuals followed the process, and the agency received formal input from 20 parties and over 400 informal public comments. The OPSB recognized that the rules review “inspired a robust discussion from numerous interested stakeholders.”

What are the proposed changes?

OPSB summarizes the rule changes it adopted as follows:

What happens next?

Parties have 30 days from the July 20 adoption date to file a request for a rehearing on OPSB’s decision to adopt the rules. A rehearing request to OPSB must be based upon an argument that the rules are unreasonable or unlawful. Absent a rehearing request, the OPSB will forward the rules package to JCARR, a committee consisting of five representatives and five senators from the Ohio legislature. JCARR must hold a public hearing to hear comments on the rules between 31 and 45 days after receiving them, then must review the rules to ensure they don’t exceed OPSB’s authority, conflict with existing rules or legislative intent, and include analyses of fiscal and business impacts. The committee will next either approve the rules or recommend invalidation of some or all of the rules by the Ohio legislature, and both the House and Senate would have to pass resolutions to follow JCARR’s invalidation recommendations. If JCARR approves the rules, they’ll go into effect right away.

By: Seungki Lee, Assistant Professor, Agricultural, Environmental, and Development Economics, The Ohio State University

Click here to access PDF version of the articles

During the last few weeks, grain futures markets have showed significant swings in response to several events: the expanding drought, USDA’s June Acreage Report, and the looming Black Sea Grain deal. The heightened uncertainty in the commodity market is causing concern among US growers about market prospects. Given the current influence of multiple variables on prices, relying solely on price indices may lead to a misinterpretation of the market outlook. Therefore, in this article, we will look into three primary factors individually that have the potential to impact the market in the upcoming months.

The first and very perceivable force that raises uncertainty is the domestic growing condition – the expanding drought in the Midwest. A striking example is that 98% of Minnesota’s crop land are currently experiencing drought (Brown, 2023). USDA’s July WASDE report adjusted down corn yield to 177.5 bushels per acre, 4 bushels down from last month, whereas soybean yield forecast was not changed. However, a substantial change in the acreage projection (corn up and soybean down) in the June USDA’s Acreage Report mainly determined the overall production estimates. This indicates that the market has not fully accounted for the potential yield reduction caused by the drought. Despite the undeniable impact of the drought, the exact extent of harvest reduction remains uncertain, further contributing to market unpredictability. Even though commodity prices hold steady, growers can be largely worse off (Probert et al., 2023). Table 1 provides a quick summary of July WASDE updates for new crop corn, soybean, and wheat.

Table 1. Summary of July WASDE Estimates

| Corn | Soybean | Wheat | |||||||

| Marketing Year | 23/24F | ∆Jun | ∆22/23 | 23/24F | ∆Jun | ∆22/23 | 23/24F | ∆Jun | ∆22/23 |

| Yield (bu/acre) | 177.5 | -4.0 | +4.1 | 52.0 | ** | +2.5 | 46.1 | +1.2 | -0.4 |

| Production | 15,320 | +55 | +1,590 | 4,300 | -210 | +24 | 1,739 | +74 | 89 |

| Total Supply | 16,747 | +5 | +1,615 | 4,575 | -185 | 0 | 2,449 | +51 | -21 |

| Feed & Residual | 5,650 | — | +225 | ||||||

| Ethanol | 5,300 | — | +75 | ||||||

| Crush | 2,300 | -10 | +80 | ||||||

| Domestic Use | 12,385 | — | +305 | 2,426 | -10 | +85 | 1,132 | +20 | +1 |

| Exports | 2,100 | — | +450 | 1,850 | -125 | -130 | 725 | — | -34 |

| Total Use | 14,485 | — | +755 | 4,276 | -135 | -45 | 1,857 | +20 | -33 |

| Ending Stocks | 2,262 | +5 | +860 | 300 | -50 | +44 | 592 | +31 | +12 |

| Price ($/bu) | 4.80 | — | -1.80 | 12.40 | +0.30 | -1.80 | 7.50 | -0.20 | +1.33 |

Note: The default unit is a million bushels if not specified.

Continue reading What Factors are Driving the Current Grain Market Volatility?

By: Peggy Kirk Hall, Attorney and Director, Agricultural & Resource Law Program

While Ohio’s “budget bill” is important for funding our agencies and programs, it always contain many provisions that aren’t at all related to the state’s budget. The budget bill provides an opportunity for legislators to throw in interests of all sorts, which tends to add challenges to reaching consensus. Though many worried about having the current budget approved in time, Ohio lawmakers did pass the two-year budget bill, H.B. 33, just ahead of its deadline on June 30.

We’ve been digging through the bill’s 6,000+ pages of budget and non-budget provisions and the Governor’s 44-item veto. Some of the provisions are proposals we’ve seen in other legislation that made their way into the budget bill. Not included in the final package were Senate-approved changes to the Current Agricultural Use Valuation law that would have adjusted reappraisals in 2023, 2024, and 2025. Here’s a summary of items we found of relevance to Ohio agriculture, not including the agency funding allocations. We also summarize three vetoes by the Governor that pulled items from the budget bill.

Township zoning referenda – ORC 519.12 and 519.25

There is now a higher requirement for the number of signatures needed on a petition to subject a township zoning amendment to referendum by placing it on the ballot for a public vote. The bill increased the number of signatures from 8% to 15% of the total vote cast in the township for all candidates for governor in the most recent general election for governor.

Legume inoculators – ORC 907.27 and 907.32

The bill eliminated Ohio’s annual Legume Inoculator’s License requirement for businesses and individuals that apply inoculants to seed. All other requirements for legume inoculants remain unchanged.

Agricultural commodity handlers–Grain Indemnity Fund – ORC 926.18

Ohio’s agricultural commodity handlers law provides reimbursement to a grain depositor if there is a bankruptcy or failure of the grain elevator. The bill revises several parts of the law that provide a depositor with 100% coverage of a grain deposit when there’s a failure:

If a commodity handler’s license is suspended and the handler failed to pay for the commodities by the date suspension occurred, the new law increases the number of days by which the commodities had to be priced prior to the suspension– from 30 to 45 days.

If a commodity handler’s license is suspended and there is a deferred payment agreement between the depositor and the handler, the new law:

Requires that the deferred payment agreement must be signed by both parties.

Increases the number of days by which the commodities had to be priced prior to the suspension — from 90 to 365 days; and

Increases the number of days by which payment for the commodity must be made pursuant to the deferred payment agreement — from 90 days to 365 days following the date of delivery.

Requiring 100% coverage when commodities were delivered and marketed under a delayed price agreement up to two years prior to a handler’s license suspension. The delivery date marked on the receipt tickets determine the two-year period. The bill also states that the Grain Indemnity Fund has no liability if the delayed price agreement was entered into more than two years prior to the commodity handler’s license suspension.

Two circumstances for 100% of loss coverage from the Grain Indemnity Fund remain unchanged by the bill: when the commodities were stored under a bailment agreement and when payment was tendered but subsequently denied. For all other losses, the new law will reduce the fund payment to 75% of the loss. Current law covers 100% of the first $10,000 of the loss and 80% of the remaining dollar value of that loss. Continue reading Ohio Budget bill includes many non-budget changes for ag

Russia’s Invasion of Ukraine: The Global Impact

The shock to global commodity markets following Russia’s invasion of Ukraine is expected to be the largest in the post-war period, and certainly since the oil crisis of the 1970s. Over the past 30 year, the two countries have become major agricultural exporters, accounting for a quarter of global grains trade in the 2021-22 season (International Grains Council, March 9, 2022). Across key commodities, they account for a 34, 18, 27 and 75 percent share of volume traded of world wheat, corn, barley, and sunflower oil respectively (International Food Policy Research Institute, February 24, 2022). With Russia blockading ports on the Black Sea, 16 million tons of grain are currently stranded in Ukraine, USDA forecasting Ukrainian-Russian wheat exports to fall by 7 million tons in 2021-22, Australian and Indian exports only partially filling the gap (USDA/WASDE Report, March 9, 2022) Also, despite reports of some spring crops being planted in Ukraine, outgoing Agriculture Minister Roman Leshchenko expects total area sown to be reduced by 19 million acres (Reuters, March 22, 2022).

The shock to global commodity markets following Russia’s invasion of Ukraine is expected to be the largest in the post-war period, and certainly since the oil crisis of the 1970s. Over the past 30 year, the two countries have become major agricultural exporters, accounting for a quarter of global grains trade in the 2021-22 season (International Grains Council, March 9, 2022). Across key commodities, they account for a 34, 18, 27 and 75 percent share of volume traded of world wheat, corn, barley, and sunflower oil respectively (International Food Policy Research Institute, February 24, 2022). With Russia blockading ports on the Black Sea, 16 million tons of grain are currently stranded in Ukraine, USDA forecasting Ukrainian-Russian wheat exports to fall by 7 million tons in 2021-22, Australian and Indian exports only partially filling the gap (USDA/WASDE Report, March 9, 2022) Also, despite reports of some spring crops being planted in Ukraine, outgoing Agriculture Minister Roman Leshchenko expects total area sown to be reduced by 19 million acres (Reuters, March 22, 2022).

Not surprisingly a market shock of this magnitude has affected both the volatility and level of prices, wheat futures at one point moving above $14/bushel, and eventually falling back to just over $10/bushel, reflecting uncertainty among traders about the invasion. In turn, the increase in grain prices, are having a significant effect on global food prices and hence food security. Even before the invasion, several factors were already driving up food prices, including poor harvests in South America, strong global demand, supply chain issues, reduced global stocks of grains and oilseeds, and an input cost squeeze mostly due to rising fertilizer prices. Adding in the effect of the invasion, global food prices are now reaching levels not seen since the so-called “Arab Spring” of the early 2010s (UN/FAO, March 2022). Continue reading How Will the Invasion of Ukraine Affect U.S. Agriculture?