The 40th Top Farmer Crop Workshop will be held July 22-25, 2007, and there is certainly no shortage of interesting topics this year! We will send an email notice when preliminary program information, including speakers and their topics, is posted on the TFCW site. If you have attended the workshop in recent years, you should be on our mailing list and will receive a printed program and registration materials by early June. To reserve your spot now, mail the registration form available at http://www.agecon.purdue.edu/topfarmer/conference_info.asp, or call Purdue Conferences at (765)494-7220.

Month: May 2007

Ohio Environment Report v4(1): Trade, the Environment, and Farm Bill Reflections

The articles in this issue of the Ohio Environment Report tackle two important issues of interest to Ohioans. First, Dr. Ian Sheldon, Andersons Professor of International Trade at Ohio State University, examines whether and how free trade affects the environment, and how trade policies can address environmental impacts. The second article considers conservation proposals for the 2007 Farm Bill, and highlights a few key issues to consider about the evolution of conservation policy in the Farm Bill.

Available at: http://aede.osu.edu/people/sohngen.1/OER/

Group Risk Insurance Plan (GRIP) – Less Attractive in 2007?

The Group Risk Insurance Plan has been an attractive insurance product the past few years for many in the Midwest . Certain counties in the Midwest had a high ratio of indemnities paid out to premiums paid in (loss ratio) with GRIP. This resulted in a comparatively attractive crop insurance product that many farmers signed up for. The article cited below examines past performance of GRIP and it’s potential for 2007 and beyond.

“GRIP in 2007”

Schnitkey and Sherrick

farmdoc – University of Illinois

http://www.farmdoc.uiuc.edu/manage/newsletters/fefo07_04/fefo07_04.html

Hogs: New Eastern Corn Belt Weekly Returns Series

In these times of changing feed prices and feeding practices, it has never been as important to thoroughly understand how profitable it is to feed hogs. However, many of the existing series that you find on the web from USDA or extension sources still base estimated returns on a finishing model that starts with the purchase of a 50 pound feeder pig and ends with the sale of a 250 or 260 pound fat hog. The industry has changed substantially – very few operations start with 50-pound feeders and most finish their hogs nearer to 270 pounds. Furthermore, some producers are beginning to introduce small amounts of dried distillers grains (DDG) into their rations to take advantage of this proliferating feed source.

This month I’ll discuss a new weekly series I’ve calculated and posted on my web page (http://aede.osu.edu/people/roe.30/livehome.htm). The series reflects the average returns to hog finishing for two different types of hog finishers. These new series borrow from recent work by John Lawrence at Iowa State that use updated budgets that include lighter feeder pigs – both 10 pound early wean pigs and lighter 40-pound feeders – and heavier finishing weights of 270 pounds. The budgets also reflect the price of finishing if 5% of the ration is supplied from dried distillers grain. The data reflects feed, hog, and feeder pig prices that are reported in the Eastern Corn Belt .

The first series is calculated for finishing 40-pound feeder pigs. The feeder pigs are priced using the USDA’s Eastern Corn Belt price series for 40-pound farm-delivered feeder pigs while the hogs are assumed to fetch the Wednesday Eastern Corn Belt lean price averaged across all sales categories (negotiated and contract prices). I assume these hogs face a 2.2% death loss during their 20 weeks on feed and that they consume 9.8 bushels of corn, 88.2 pounds of 48% soybean meal and 34.2 pounds of DDG. All other costs, including other ration components, vet charges, labor, utilities, facilities, etc. are assumed to cost $28.47.

The second series focuses on the finishing costs for early wean pigs. I assume these hogs face a 5% death loss during their 25 weeks on feed and that they consume 10.7 bushels of corn, 122 pounds of bean meal and 34 pounds of DDG. All other costs are assumed to cost $34.75. Many of these production and cost assumptions are based on recent Iowa State hog budgets. Of course, every producer may face slightly different feed efficiencies, death loss and other costs. Therefore, I’ve set up the spreadsheet so the user can alter one or more of the components for any of the three series; this, in turn, changes the entire series of data generated and the resulting summary statistics. A third series, provided for reference, is also included on the spreadsheet – it uses assumptions typical for older finishing return series, including a lighter feed-out weight of 250 pounds and no use of DDG.

The spreadsheet contains data for hogs placed beginning the first week of 2002 through the end of March of 2007. The summary statistics reveal several interesting trends. First, finishing early wean pigs yielded the highest average returns over the time period investigated. The average net returns for finishing early wean pigs was $8.71 per hog while it was only $6.05 for finishing 40-pound feeder pigs. This difference in returns may be the reason why there are 2.5 early wean pigs sold for each 40-pound feeder pig sold in the U.S. today. The old net returns series, which reflects feeding pigs from 40 pounds to 250 pounds, average a $4 loss per pig over the time period. Clearly, feeding pigs to greater end weights has increased operational returns.

When looking across the various months, several clear patterns also emerged. For example, December through May were the most profitable months for producers finishing 40-pound feeder pigs over the past 5 years. In fact, December, which provided some of the most financial distressing months in the 1990’s, yielded the second highest average net returns for these finishers. July, August and September were the least profitable months over the past 5 years.

The seasonal profit pattern for the finishers of early weaned pigs is different. The most profitable months for these finishers are shifted four months later: March through August. The traditional heavy-slaughter months of October through December provide the lowest average profits for this segment of the finishing sector though, even here, the average net returns remained positive for the 2002-2006 period.

The spreadsheet also allows a user to input projected weekly prices for feeder pigs, hogs and feed stuffs over the next year or two on the ‘weekly data’ sheet. This allows a user to generate customized feeding returns predictions, which can be used for the purposes of planning.

What are Your Chances of an Audit?

According to the IRS 2006 Data Book, PUB 55B, of the 584,000 individual returns filed showing gross receipts from farming, 2,895 were audited in 2006. With Schedule F receipts less than $100,000 the audit rate was .42%. Farms with Schedule F gross receipts above $100,000 had a .58% audit rate. Compare this to Schedule C, Individual Business returns, that had an audit rate of 2.21% for receipts $25-100,000 and an audit rate of 3.9% for over $100,000 receipts. However, in the words of Trenna Grabowski CPA, instructor for Extension’s Ohio Income Tax School and editor of the Farm Tax Saver, do not be “lulled into complacency” since the word is out and IRS has beefed up the audit process and resources.

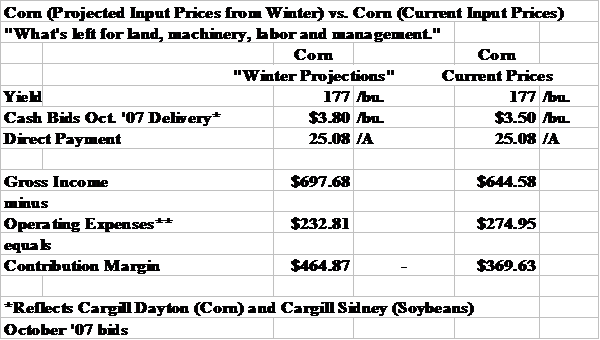

Projected Large Profits in 2007 for Crop Producers? Higher Input Costs May Shrink Bottom Line

Higher commodity crop prices have fueled projections that corn and soybean producers will net large profits in 2007. In early winter the prospect of relatively stable input prices (namely nitrogen and fuel) fueled speculation about large profits for the 2007 crop year. And with good weather and yields, many crop producers will see a very healthy bottom line this year. But, it may not be quite the windfall that many were predicting just 3-4 months ago.

The combination of much higher nitrogen prices, higher phosphorous prices, higher seed costs due to the transition to stacked trait genetics, higher crop insurance costs, higher fuel costs, higher rents on many land parcels, and now, lower commodity prices compared to the pre-March 31 st Planting Intentions Report have seen that large profit potential shrink some.

Some of these cost increases were expected in late fall and early winter as higher commodity prices for 2006 and 2007 crops pointed toward higher crop insurance costs and potential increases in land rents for some farmers. Many producers had already made seed buying decisions which included stacked trait corn hybrids that add $20 per acre to variable costs. Fertilizer cost increases have been a surprise to many as nitrogen prices have equaled and in many places surpassed the very high prices of last year. Recent surveys reveal nitrogen in the form of anhydrous ammonia priced at $600/ton and nitrogen in the form of UAN (28%) priced at $225-$295/ton. Expectations were for nitrogen prices to remain at much lower levels. Last fall and early winter, predictions for prices were closer to $450/ton for anhydrous and $200/ton for 28%. There were some pricing opportunities at these prices but for many the possibility was there only if on-farm storage was available. Some pre-pricing opportunities in early winter allowed producers to lock in prices close to these lower levels but many didn’t get their entire needs locked in. So what does this mean for the 2007 bottom line? Let’s compare contribution margins (gross revenue minus variable costs) for corn with 2 sets of variable costs: projected variable costs in early winter (with lower crop insurance costs) and today’s updated variable costs (including higher crop insurance costs).

Projected 2007 Variable Costs (Fall 2006)

Nitrogen $45/acre ($450/ton NH3)

Seed $40/acre ($92/bag)

Insurance $7.75/acre (70% CRC)

Today’s 2007 Variable Costs

Nitrogen $60/acre ($600/ton NH3)

Seed $60/acre ($142/bag stacked trait)

Insurance $11.50/acre (70% CRC)

Incorporating these costs differences and declining commodity prices into a profit analysis reveals a contribution margin of $95.24 less then projections in early winter.

The following is a look at the difference in contribution margins from early winter when cost projections were lower and now with higher input costs facing us.

OSU Web Resources for Next U.S. Farm Bill

As debate continues on the contents of the next U.S. farm bill scheduled to be passed later this year or in 2008, a number of issues are likely to be contested. OSU’s Department of Agricultural, Environmental, and Development Economics has a web page compiling analysis and commentary by their various experts on some of these issues. Articles will be added as they are produced. The latest postings include “It’s the Process, Isn’t It? Reflections on the 2007 Farm Bill Debate,” Brent Sohngen’s thoughts on the growing importance of conservation provisions in Farm Bill negotiations, especially as related to agriculture’s role in future U.S. domestic energy production. Carl Zulauf ‘s “Changes in Farm Support Rates” is the first of several articles looking at components of Title I – the commodity section of the legislation. Also included is Ian Sheldon’s “Trade and the Environment: Will there be a Race to the Bottom?,” a look at the related issue of the environment’s role in trade negotiations under agreements such as NAFTA and the WTO. The web address for these Farm Bill resources and others to come is

Corn or Soybeans – What to Plant on Those Undecided Acres?

If you still have acres to be planted that are in the undecided category for planting to corn or soybeans, it would helpful to analyze your profit potential. The following is a quick look at the contribution margin (gross revenue minus variable expenses) using OSU Extension Enterprise Budget numbers and up-to-date forward cash bids for October ’07.

The first set of analyses examines 2nd Year Corn versus Soybeans with higher priced N ($580/ton NH3). The analysis on the left assumes 2nd Year Corn with a 10% Yield drag. The analysis on the right assumes a 5% Yield drag for second year corn. The Operating Expenses include nothing for land, machinery, labor and management. If corn does incur more costs for machinery, labor and management on your farm the Corn “Advantage” may have to be higher to offset these higher fixed costs.

Be sure to incorporate your own costs and commodity prices into this type of analysis as your numbers will almost certainly be different from the ones we have in our analysis. And be sure to accurately assess relative yield potential on the parcel in question. This will be very important in the analysis. 180 bushel 2nd Year Corn versus 55 bushel soybeans certainly would change the analysis (full analysis available here: https://bpb-us-w2.wpmucdn.com/u.osu.edu/dist/9/29991/files/2010/08/corn_soyanalysis.pdf)

Flexible Cash Lease Arrangements and Government Payments Clarified

This USDA Notice clarifies the Flexible or Variable Leasing issue as it pertains to whether these agreements should be considered as cash or share leases for Direct Crop Payments. It also addresses the impact to the CCC-509 payment shares for bonuses paid to landowners. A cash lease has payment based upon cash, a fixed number of bushels or pounds of crop. A share lease contains provisions that require one or a combination of a payment of rent based on the amount of crop produced, proceeds derived from the crop and/or interest the producer would have had, if the crop had been produced. Also, the greater of a guaranteed amount or share of the crop proceeds. And, FSA will consider it a share lease if there is a guaranteed amount (such as a fixed dollar amount or quanity) and a share of the crop proceeds paid as rent. In the Flexible examples within the notice, it would appear that if the flexibility is based upon factors external to the farm, it would be classified as a cash lease. If the lease is based on performance on the farm, it is a share lease. Read this USDA FSA notice so that you will know the latest information on the subject. http://www.fsa.usda.gov/Internet/FSA_Notice/dcp_172.pdf

Buying and Selling Tractors on eBay: Differences from In-Person Auctions

(click here to view PDF version)

Few sounds capture the rhythm of agricultural economies better than the syncopated cadence of an auctioneer echoing across a clutch of farmers gathered around the auction block. This seemingly timeless portrait of economic exchange in rural America has changed, however, as advances in technology alter the way auctions are conducted. The advent of telephone bidding, video links and, more recently, internet bidding platforms change the nature of auctions by broadening the pool of potential sellers and bidders. As the commercial success of eBay and other online auction sites suggest, the internet provides many possible advantages over in-person auctions. Internet auction sites provide extensive listings and powerful search technologies, which can create markets for specialized product categories, even when buyers and sellers are geographically dispersed. This issue is particularly important for U.S. agriculture because, as production becomes increasingly concentrated among fewer entities, the number of potential bidders within a given radius of any particular location continues to diminish.

A key strength of the internet – the pooling of bidders from geographically dispersed locations – can also be a weakness, as distance removes a critical advantage of in-person auctions, i.e., bidders directly inspecting merchandise. While some internet sites that hold agricultural equipment auctions attempt to directly offset this weakness by providing inspection services (e.g., www.IronPlanet.com), the most widely used internet auction site, eBay, does not provide such up-front risk mitigation services. eBay does other things, however, including the posting of reliability ratings of individual sellers and the use of on-line photos and videos that allow buyers to inspect aspects of goods from a distance. Starting in June of 2005, eBay also began offering its Buyer Protection Plan, an after-the-fact risk mitigation service to business equipment purchasers in the form of a fraud protection policy that refunds buyers’ outlays up to $20,000 for business equipment (including farm equipment) sold by eBay sellers in the case of seller fraud or undisclosed equipment defects.

KEY QUESTIONS

As online sales of farm equipment become more widespread, questions arise about the nature of price determination in online versus traditional markets. We present empirical evidence from recent auctions for used farm tractors conducted on eBay and via in-person auctions. We are interested in several questions. Do eBay and in-person auctions yield similar average prices for comparable equipment? Second, what influences whether tractors are offered for sale on eBay versus in-person auctions? Then, we want to take a step back and ask, what kind of tractors are being offered for sale on eBay and which ones are actually getting sold, i.e., generating bids that surpass reserve prices? In this installment we focus on the first question: does comparable equipment sell for the same on eBay and in in-person auctions?

DATA

To answer this question we use data from internet and in-person used tractor auctions conducted between June 1, 2005 and March 31, 2006 in 11 Midwestern states (IA, IL, IN, KS, MI, MN, NE, ND, OH, SD, WI). The internet sample was purchased through eBay’s service provider program. The data includes information about auctions that took place in eBay’s “Tractor and Farm Machinery” category, including the final sales price, make, model, engine horsepower, year, hours of use, auction date, seller zip code, and other information describing the auction items and the nature of the auction. The in-person auction data was purchased from Machinery Pete’s Farm Equipment FACT’s Report, which summarizes results from retirement, estate, dealer and consignment auctions reported by a network of more than 600 auctioneers. The FACT’s information includes sales price, make, model, engine horsepower, year, hours of use, auction date and location (region within a state), and other descriptive information. The data do not represent the entire universe of used tractor transactions for the Midwest during this period, as other internet auction sites regularly transact tractors and some auctioneers may not report to the FACT’s Report, but this likely represents a wide, representative sample from the universe of used tractors.

Several filters were applied to each data set to arrive at a sample used for analysis. For both samples, tractors with model years earlier than 1960 were excluded to focus on tractors that were most likely purchased for operational rather than collectible purposes. Also tractors of 30 horsepower and less were excluded to focus on tractors most likely to be used in agriculture rather than nursery or landscape operations. Items that were classified by the seller as “for parts” or “not running” and items that were sold with expensive additional implements such as backhoes were excluded. Items with less expensive implements such as loaders or mowers were included. Finally, the data set was also limited to the 13 manufacturers (makes) that contributed more than 89 percent of sample observations (John Deere, International Harvestor, Massey Fergusson, Ford, Case, CaseIH, New Holland, Ford-New Holland, Allis Chalmers, Oliver, White, Versatile, and Belarus). The complete data set (see table 1 for summary statistics) included 588 eBay observations (about 30% of all observations) and 1,770 in-person observations for a total of 2,358.

APPROACH

The way we approach answering our key question is to find the statistical relationship between the price of a used tractor and its key attributes like horse power, hours, age, manufacturer and transmission type. This is known as the hedonic modeling approach. We use the data and some statistical techniques to develop this relationship for both tractors sold on eBay and in in-person auctions. We then predict each tractor’s sale price for both auction venues (eBay and in-person), apply the relevant commissions and calculate the difference.

We’ll note a couple things about commissions. eBay commissions for business and industrial capital equipment sales are 1% of the final sale price with a maximum charge of $250, a $20 listing fee, and a variety of optional fixed-fee listing enhancements (e.g., bold lettering) targeted to improve item visibility among potential bidders (we assume $55 in additional fees).

In-person auctions feature commissions that typically range from 2.5 percent to 15 percent, often with no limit on the maximum total commission paid. To the best of our knowledge, detailed information concerning the average commission structures for U.S. farm equipment auctions is not available, though industry sources suggest that the bulk of commissions fall in the five to ten percent range. The data provided to us from the FACT’s report does not include information concerning the commission or fees charged. As a point of reference, we list the commission structure of an internet-based auction house, IronPlanet.com, which provides features similar to that of an in-person auction company, including equipment inspection and lien searches. This firm features a block-rate commission structure outlined in table 2. We also assume each sale costs an additional $450 in fees. The eBay – in-person difference between the total commissions paid for various sales prices can vary dramatically; the difference for a $1,000 item is about $100 and the difference for a $100,000 item is more than $6,000.

In table 3 we list six example calculations for the predicted price in each sale venue, the difference in net sales revenues between the two venues, and the size of the in-person commission that would make eBay and in-person auctions yield the same net sales revenue. We also provide the average and median across all tractors in the sample and for all tractors that sold for less than $20,000 and, hence, would be covered by eBay’s Buyer Protection Program.

The results are quite stark. The median tractor (i.e., half of the tractors sold for a price less than this tractor, the other half sold for more) was predicted to sell for $7,706 on eBay and for $10,996 at an in-person auction. Once the typical commissions and fees are deducted this results in a $2,197 more from an in-person sale. In fact, the commission on the in-person auction would need to rise to 31.3% before both venues would offer the same predicted level of net sales revenues. We do not adjust for the differences in other costs that accompany a sale in each venue. For example, at an in-person auction, the seller must transport the tractor to the sale location, which could erode the perceived advantage of in-person auctions with regard to net revenues as eBay sellers need not transport the item to a central location. On the other hand, eBay sellers may incur costs associated with internet technology, including the cost of the computer, internet hook up, and any charges for taking digital photos or videos to post on the eBay sale site, though many of these costs may be quite small if the seller already is engaged with internet activities.

The average tractor in the sample is predicted to sell on eBay for less than half the price it is predicted to fetch at an in-person auction. In fact, all three of our example tractors in the top half of table 3, which are predicted to sell for more than $20,000 at an in-person auction, are predicted to sell for considerably less on eBay. For example, the Case-IH tractor is predicted to generate $23,367 less if sold on eBay than if sold at an in-person auction.

Once we move to the smaller, older, lesser-valued tractors depicted in the bottom half of table 3, we see that the eBay discount persists but is diminished. Recall, all these tractors would be covered by eBay’s Buyer Protection Program as each is predicted to sell for less than $20,000. The net sales revenues for the median tractor in the ‘under $20,000’ sample are only $489 less if sold on eBay, though this still translates to the idea that an in-person auctioneer could charge a 26.1% commission and still generate similar net sales revenues. However, at this point, the added costs of transporting the item to the sale and the inconvenience with such transportation may begin to grow closer to the $489 bump in revenue promised by the in-person sale. In fact, for 2 of the 3 example tractors in the bottom half of table 3, eBay generates higher net sales revenues, including $1,416 more for that 43-year-old Allis Chalmers D17 with a front-end loader.

Another more straightforward way to verify if the two auction venues are generating similar prices is to simply compare the price for a single used tractor model that is frequently sold in both outlets. The most commonly sold used tractor in this data set is the John Deere 4020. More than 57,000 units of this tractor were produced by John Deere at its Waterloo, Iowa, factory between 1963 and 1971, making it one of the most common models ever produced in U.S. agriculture. Our data set includes the sales price of 83 units, including 23 sold via eBay. The in-person and eBay 4020’s had statistically similar profiles with respect to age, hours, presence of ancillary implements, reliance upon diesel fuel and horsepower, though about 13 percent of the eBay 4020’s feature manual transmission while none in in-person auctions list this feature (if we leave these tractors out, it doesn’t change our results). So, other than the difference in transmission types, eBay and in-person offerings of the 4020 appear to quite similar with regard to their attributes. (We would have liked to do this with more models, but there weren’t other models with enough sales in both venues to provide a statistically rigorous test).

The mean in-person auction price ($8,212.50) is quite close to that of the eBay sample ($8,166.37). Several statistical tests suggest that the two venues yield the same sales price for this venerable tractor. Hence, in-person and eBay auctions provide similar prices for the John Deere 4020’s sold in the Midwest during this time frame. This provides some additional evidence of convergence in average sales prices for used tractors that sell for less than the upper limit of eBay’s consumer protection policy.

SUMMARY

Markets for durable and non-durable agricultural inputs are being altered by the emergence internet-based trading venues. We explore differences between internet and traditional markets for used tractors using data from eBay and in-person used tractor auctions. We find the average price received in eBay auctions is substantially lower than that received in in-person auctions; the average tractor in our sample is predicted to generate nearly $10,000 less in net sales revenue if sold on eBay. However, the percentage discount for eBay tractors is smaller for items that sell for less than $20,000 – the price threshold beyond which goods are no longer covered by eBay’s Buyer Protection Program. In fact, for the most frequently traded model in our data set (the John Deere 4020), which normally sells for prices well below the $20,000 threshold, the distribution of prices obtained in eBay and in-person auctions is no different.

This suggest that, from the buyer’s point of view, purchasing newer, more powerful tractors on eBay may offer the opportunity to source key capital inputs at a discount compared to traditional in-person auctions. However, these buyers must bear additional risk both because they cannot be present to personally inspect the merchandise and because occurrences of fraud or misrepresentation cannot be fully covered under existing eBay’s Buyer Protection Program, which currently covers items up to only $20,000.

From a seller’s point of view eBay is attractive because it offers great flexibility (e.g., absolute freedom to choose sale dates, no transportation of equipment to a central location) and low commissions (capped at $250). However, for tractors that sellers think will sell above the $20,000 limit of the eBay buyer protection program, our calculations suggest that in-person auctions generate greater total seller revenue, i.e., the higher commissions paid to in-person auctioneers are outstripped by higher selling prices. Indeed, the in-person flat commission rate that we predict would equalize seller revenues gained from eBay and in-person auctions averages 31.3 percent, which is double the highest commission charged by in-person auctioneers.

Smaller, older tractors, which commonly sell for prices less than $20,000, can often generate more revenue if sold on eBay. The in-person flat commission rate that would equalize seller revenues gained from eBay and in-person auctions averages only 29.2% percent across our sample of used tractors that sell for less than $20,000, while 39 percent of the tractors that sold for less than $20,000 in our sample are predicted to generate more seller revenue if sold on eBay. For the internet-savvy seller with older tractors to sell, eBay may be an attractive sales outlet.