(click here to view PDF version)

We try to make money and build assets, invest instead of spend and build the farm business during our lifetime. But then when we think we have it made, the debt load is no longer burdensome, the kids are raised, and maybe even some have stayed on the farm and joined the business, we have to worry about how to transfer the farm business while treating equitably those kids who didn’t stay on the farm. Further, most don’t like to think about death, let alone plan for after death. So, estate planning isn’t easy, but for farmers is a necessity.

Two things make an estate plan more important for farmers than for others:

- Farmers live poor but die rich, usually land rich. The more assets you have the more important an estate plan, so that the farm won’t have to be liquidated to pay estate settlement costs.

- The government has a plan for you if you choose not to do estate planning. It used to be that the government’s plan minimized estate settlement costs. However, that has changed. Now the government’s plan maximizes estate settlement costs for well to do farmers who die rich.

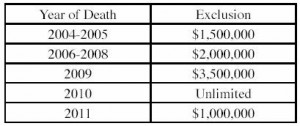

The size of your estate where the federal government will take nearly half of your estate is indicated in the table below. For those that will die in 2005, $1.5 million dollars are sheltered from federal estate tax; in 2006 to 2008, $2 million; 2009, $3.5 million; 2010, no limit to dollars that can be passed to heirs federal estate tax free; but in 2011 and beyond, according to present law, only $1 million can be passed on without the federal government taking nearly half. The bottom line – if your estate is or may be worth over a million dollars in 7 years and you plan to live that long, you have 7 years to get your affairs in order.

You also need an estate plan (at least a will) if your wishes are different than the plan that the State of Ohio has for your money if you die without a will. Before a recent law change without a will all assets were divided up between a surviving spouse and children. Now, if (but only if) all children are of the surviving spouse, that spouse gets all.

If there has been a divorce and not all children were adopted or of the surviving spouse, assets are still divided between spouse and children. If the surviving spouse is not the parent of any of the surviving children, the spouse first gets $20,000. If the surviving spouse is the parent of at least one, but not of all the surviving children, the spouse first gets $60,000.

If there is only one child and that child is not of the surviving spouse, the residual after the spouse’s $20,000 is divided equally between the spouse and child. If there are children and at least one is not of the surviving spouse, 1/3 of the residual plus the initial $20,000 or $60,000 goes to the surviving spouse. The remaining 2/3 of the residual is then divided equally between the children.

If there are no children or spouse, surviving parent(s) get all. If no surviving parent(s) assets are divided between brother(s) and/or sister(s) and to their descendent(s) if not alive. If no brother(s) or sister(s) or their descendant(s), assets are divided equally between the paternal and maternal sides, going to grandparent(s) if alive but then to descendants if deceased.

Following are some issues that need to be considered in an estate plan

- the need for dollars to cover retirement (including the second to die) plus estate settlement costs vs. passing on as much as possible

- treat children equally or equitably

- passing farm business, control and assets to children now vs. after death

- minimize estate settlement costs (taxes, attorney fees, etc.) vs. extra time, hassle and expense now to minimize costs later

- land preservation wishes vs. minimizing capital gain liability when and if the farm is sold.

With estate planning the objective is to settle the estate while keeping all heirs as happy as possible. In most situations children or heirs will be happier if involved in reviewing and reacting to the estate plan before implemented. If done, this should be done in a manner that treats all children equally while inviting suggestions and confirming the parents’ perceptions of the children’s preferences. However, seldom can all of the children’s preferences be accommodated, so it is the parents’ right and responsibility to make the allocation and then inform all the children at the same time, in the same manner and in the same way.

If you are interested in learning more about estate planning, help is available. A letter study course is available that allows you to proceed at your own pace and in the comfort of your home. The course is easy to understand, even for those not good in financial or legal matters. Both personal and financial aspects of estate planning are covered. The course has been developed by Dr. James Skeeles, Extension Educator of Ohio State University Extension in Lorain County and has been updated and added to by Russell N. Cunningham, Attorney and Ohio State Bar Association Certified Specialist in

Estate Planning, Trust and Probate Law with the firm of Barrett, Easterday, Cunningham & Eselgroth LLP in Dublin , Ohio . The letter study consists of 12 lessons. Each lesson contains the lesson (average length is 6 pages), 1-2 pages of questions on the lesson and an answer sheet for the previous lesson.

There are four different options to obtain the letter study. For as little as $15 you can receive the letter study as an attachment to an Email (or download it from the web if doing all at once is not possible because this is a large file containing 4,429 K), for $20 get it on CD, for $25 have the complete notebook mailed to you or for $30 have 12 lessons and notebook mailed to your home each week starting the first week in January. All options except the lesson per week are available now.

Topics of each lesson, in order are as follows:

Lesson 1 Consider not just $ but also human side, getting started on your estate plan

Lesson 2 Costs of settling an estate

Lesson 3 How you own your property affects estate planning and property transfer

Lesson 4 Wills, what if no will, Power of Attorney for Health Care and Living Wills

Lesson 5 Letter of Instruction

Lesson 6 Life Insurance

Lesson 7 Trusts

Lesson 8 Giving as estate planning tool, to heirs or charity

Lesson 9 Using equity in home/farm? – reverse mortgage, life estate

Lesson 10 Nursing Home Dilemma

Lesson 11 Medical Insurance, Medicare and Medicaid

Lesson 12 Generation Skipping Trust, Limited Liability Co., Conservation Easement

Any of the above will allow you to learn the details and gain valuable insights on estate planning in the comfort of your home.

To enroll, send your name, address (Email address if you choose the sending by Email option) and check to Russell Cunningham, Letter Study, 7269 Sawmill Road, Dublin, OH 43016. This course can save you money, but the main benefit is that you will be more at ease with estate planning, thus more willing to proceed with your plan.