by: Barry Ward, Leader, Production Business Management & Director, OSU Income Tax Schools

Prevented Planting Crop Insurance Indemnity Payments

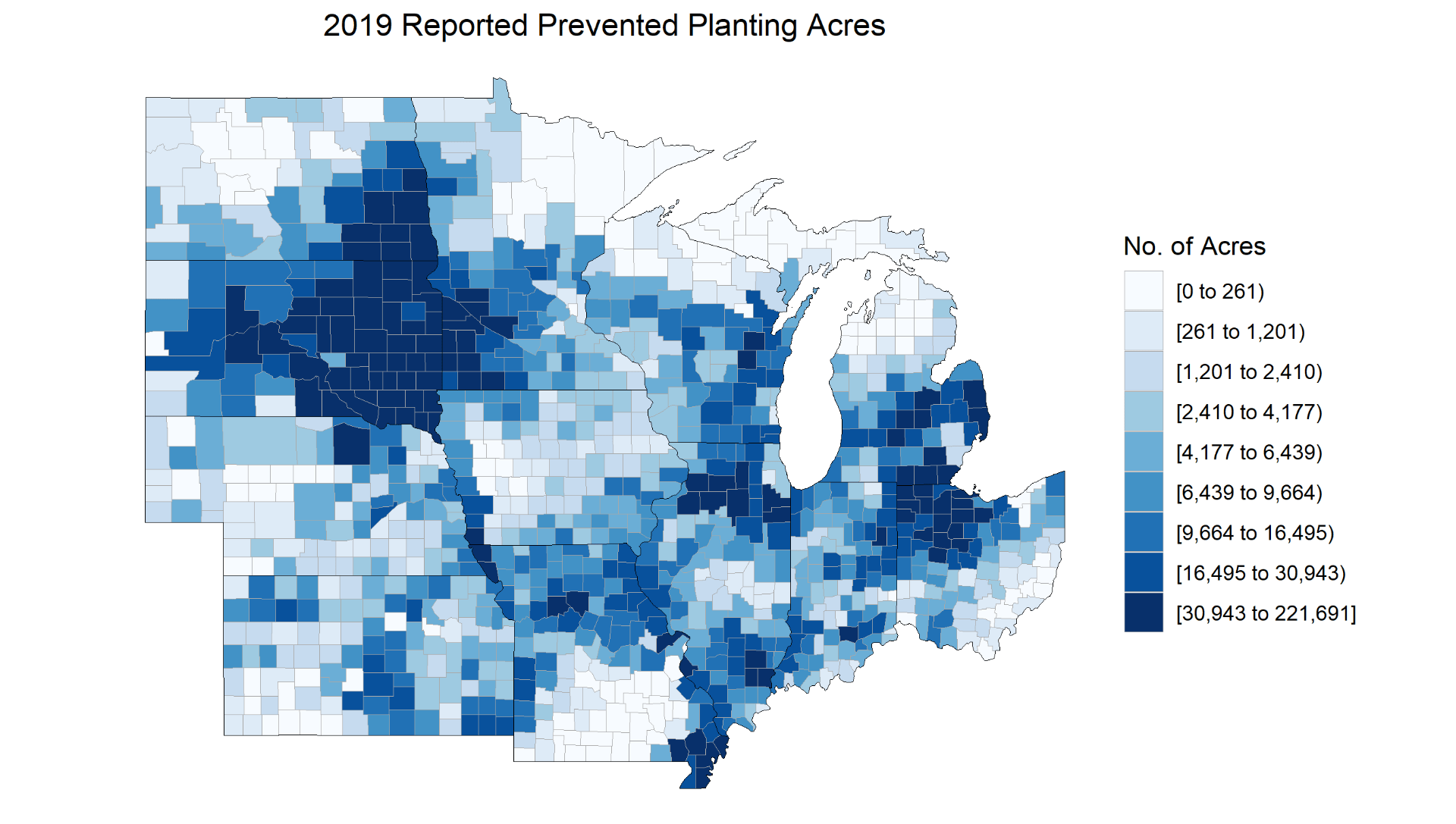

With unprecedented amounts of prevented planting insurance claims this year in Ohio and other parts of the Midwest, many producers will be considering different tax management strategies in dealing with this unusual income stream. In a normal year, producers have flexibility in how they generate and report income. In a year such as this when they will have a large amount of income from insurance indemnity payments the flexibility is greatly reduced. In a normal year a producer may sell a part of grain produced in the year of production and store the remainder until the following year to potentially take advantage of higher prices and/or stronger basis. For example, a producer harvests 200,000 bushels of corn in 2019, sells 100,000 bushels this year and the remainder in 2020. As most producers use the cash method of accounting and file taxes as a cash based filer, the production sold in the following year is reported as income in that year and not in the year of production. This allows for flexibility when dealing with the ups and downs of farm revenue.

Generally, crop insurance proceeds should be included in gross income in the year the payments are received, however Internal Revenue Code Section (IRC §) 451(f) provides a special provision that allows insurance proceeds to be deferred if they are received as a result of “destruction or damage to crops.”

As prevented planting insurance proceeds qualify under this definition, they can qualify for a 1 year deferral for inclusion in taxable income. These proceeds can qualify if the producer meets the following criteria:

- Taxpayer uses the cash method of accounting.

- Taxpayer receives the crop insurance proceeds in the same tax year the crops are damaged.

- Taxpayer shows that under their normal business practice they would have included income from the damaged crops in any tax year following the year the damage occurred.

The third criteria is the sometimes the problem. Most can meet the criteria, although if producers want reasonable audit protection, they should have records showing the normal practice of deferring sales of grain produced and harvested in year 1 subsequently stored and sold in the following year. To safely “show that under their normal business practice they would have included income from the damaged crops in any tax year following the year the damage occurred” the taxpayer should follow IRS Revenue Ruling 75-145 that requires that he or she would have reported more than 50 percent of the income from the damaged or destroyed crops in the year following the loss. A reasonable interpretation in meeting the 50% test is that a farmer may aggregate the historical sales for crops receiving insurance proceeds but tax practitioners differ on the interpretation of how this test may be met.

One big problem with these crop insurance proceeds is that a producer can’t divide it between years. It is either claimed in the year the damage occurred and the crop insurance proceeds were received or it is all deferred until the following year. The election to defer recognition of crop insurance proceeds that qualify is an all or nothing election for each trade or business IRS Revenue Ruling 74-145, 1971-1.

Tax planning options for producers depend a great deal on past income and future income prospects. Producers that have lower taxable income in the last 3 years (or tax brackets that weren’t completely filled) may want to consider claiming the prevented planting insurance proceeds this year and using Income Averaging to spread some of this year’s income into the prior 3 years. Producers that have had high income in the past 3 years and will experience high net income in 2019 may consider deferring these insurance proceeds to 2020 if they feel that this year may have lower farm net income.

Market Facilitation Payments

When the next round(s) of Market Facilitation Payments (MFPs) are issued, they will be treated the same as the previous rounds for income tax purposes. These payments must be taken as taxable income in the year they are received. As these payments are intended to replace income due to low prices stemming from trade disputes, these payments should be included in gross income in the year received. As these payments constitute earnings from the farmers’ trade or business they are subject to federal income tax and self-employment tax. Producers will almost certainly not have the option to defer these taxes until next year. Some producers waited until early 2019 to report production from 2018 and therefore will report this income from the first round of Market Facilitation Payments as taxable income in 2019.

Producers will likely not have the option of delaying their reporting and subsequent MFP payments due to the fact they are contingent upon planted acreage reporting of eligible crops and not yield reporting as the first round of MFP payments were.

Cost Share Payments

Increased prevented planting acres this year have many producers considering cover crops to better manage weeds and erosion and possibly qualify for a reduced MFP. There is also the possibility that producers will be eligible for cost-share payments via the Natural Resources Conservation Service for planting cover crops. Producers should be aware that these cost-share payments will be included on Form 1099-G that they will receive and the cost-share payments will need to be included as income.

You are advised to consult a tax professional for clarification of these issues as they relate to your circumstances.