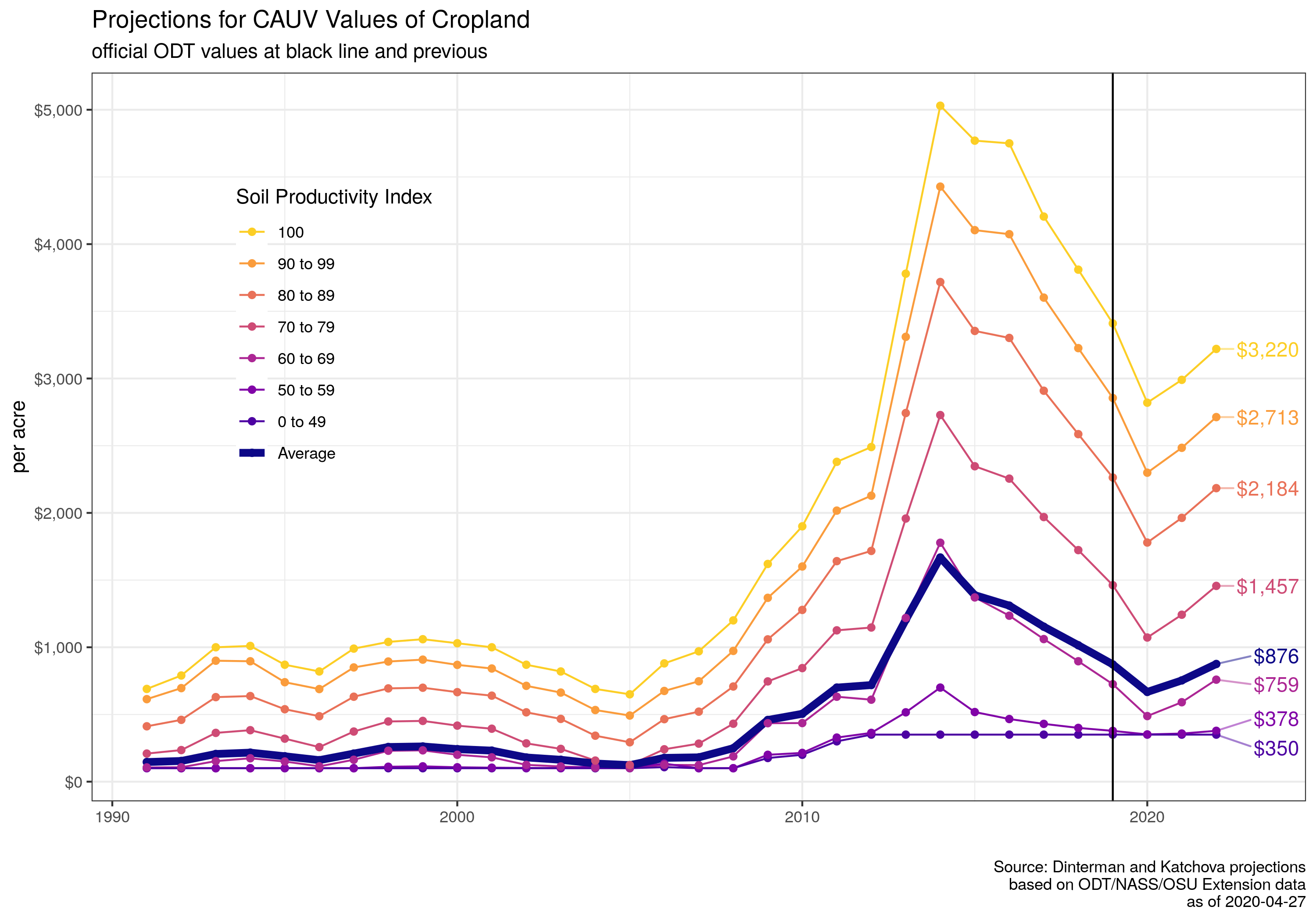

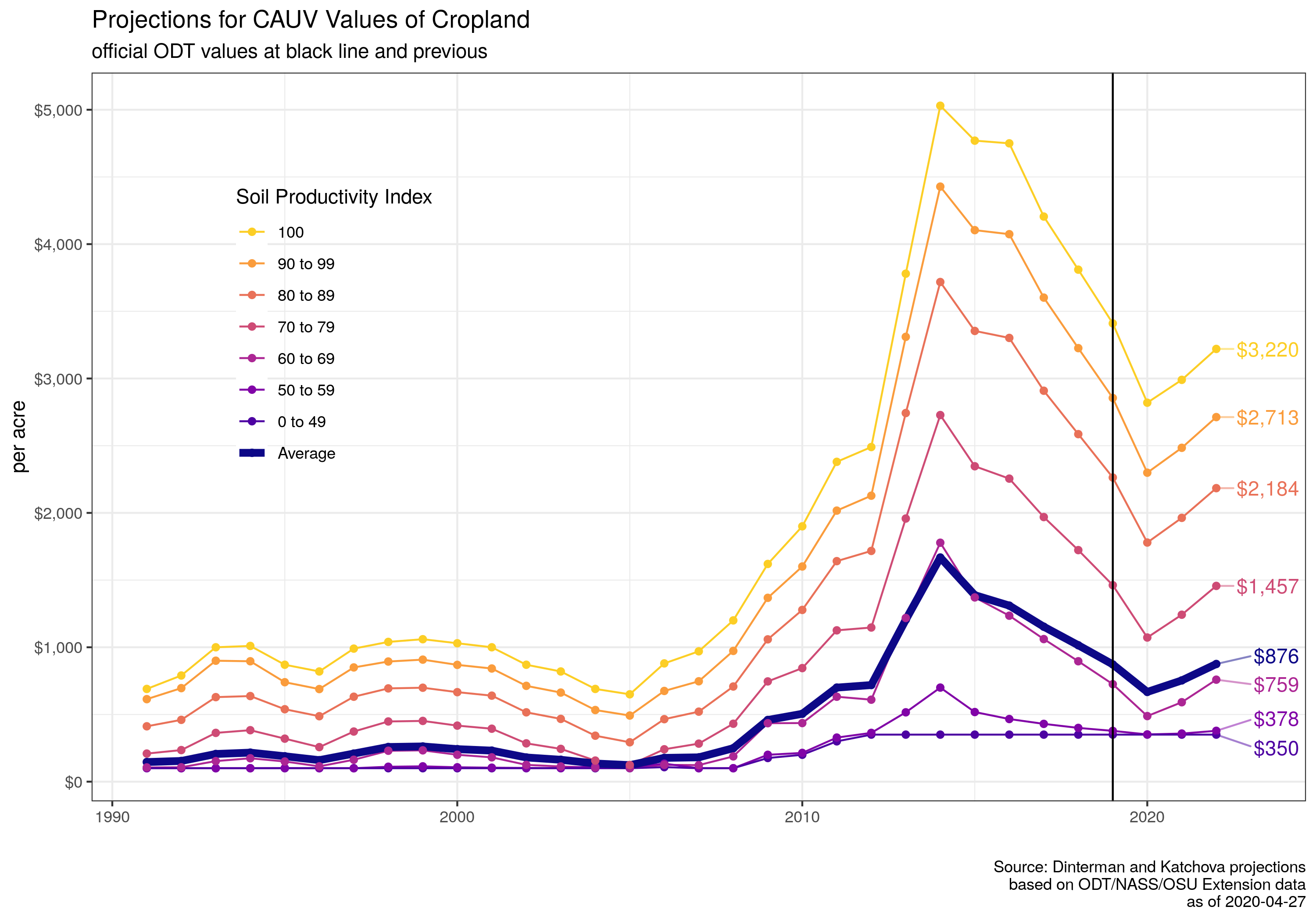

There’s a bit of good news for Ohio farmers to counter the bad news caused by COVID-19, as well as by last year’s historic rain. In counties scheduled for property value updates in 2020—about half of Ohio’s 88 counties—the average value of farmland enrolled in the Current Agricultural Use Value (CAUV) program should be about 40% lower than 2017–2019, or about $665 per acre.

That’s according to projections by researchers at The Ohio State University College of Food, Agricultural, and Environmental Sciences (CFAES).

The same projections say that in counties due for property value updates in 2021—another quarter of Ohio’s counties—average CAUV values should be about 25% less than 2018–2020, or about $760 per acre.

The declines should mean lower property taxes, on average, for most of the farmers in those counties.

The projections were published in a May report by postdoctoral researcher Robert Dinterman and Ani Katchova, associate professor and farm income enhancement chair, both of CFAES’ Department of Agricultural, Environmental, and Development Economics.

“Less money paid in property tax will help reduce farmers’ costs and allow them to keep a greater share of the revenues they bring in,” Dinterman said. Continue reading Tax Value of Farmland Expected to Drop →