If you have an Ohio Pesticide or Fertilizer Applicators License it will expire on March 31, 2022. We will be holding the final opportunity for recertification in Northwest Ohio on March 24th at 5:ooPM. The event will be held in the Youth Activities Building on the Allen County Fairgrounds. The fertilizer session (Category 15) will run from 5-6pm followed by the pesticide portion (Categories 1,2,6 and Core) Please register today by calling us at (419) 879-9108 or by email at schroeder.307@osu.edu Registration cost is $10 for fertilizer recertification and $35 for pesticide recertification and includes educational materials and refreshments. The registration fee can be paid at the door with cash or check made out to OSU Extension – Allen County. This fee is separate from the Ohio Department of Agriculture license renewal fee of $30.

If you have an Ohio Pesticide or Fertilizer Applicators License it will expire on March 31, 2022. We will be holding the final opportunity for recertification in Northwest Ohio on March 24th at 5:ooPM. The event will be held in the Youth Activities Building on the Allen County Fairgrounds. The fertilizer session (Category 15) will run from 5-6pm followed by the pesticide portion (Categories 1,2,6 and Core) Please register today by calling us at (419) 879-9108 or by email at schroeder.307@osu.edu Registration cost is $10 for fertilizer recertification and $35 for pesticide recertification and includes educational materials and refreshments. The registration fee can be paid at the door with cash or check made out to OSU Extension – Allen County. This fee is separate from the Ohio Department of Agriculture license renewal fee of $30.

Farm Policy

Allen County Ag Outlook and Agronomy Day

By Clint Schroeder

Join OSU Extension at the Allen County Fairgrounds, in Lima, Ohio, on Tuesday, February 8, 2022, starting at 9:00 a.m. for the Allen County Ag Outlook and Agronomy Day. The morning session will focus on commodity market outlook and ag policy. In the afternoon you will find answers to your agronomy questions, obtain pesticide applicator and fertilizer recertification credits, and CCA education hours as you prepare for the next growing season. The program will wrap up at 3:30 p.m.

Please RSVP by January 31, 2022 by contacting OSU Extension Allen County at 419-879-9108 or email Clint Schroeder at schroeder.307@osu.edu. The event will be held in the Youth Activities Building on the Allen County Fairgrounds, 2750 Harding Highway, Lima, OH 45804.

Doors open at 8:30 a.m; event starts at 9 a.m. Pre-registration by 1/31/2022 is required and the $15 admission can be paid at the door. Registration fee covers coffee and rolls, lunch, information packet, and education credits.

The 2022 PLC and ARC Decision

By: Gary Schnitkey, Nick Paulson, and Krista Swanson – Department of Agricultural and Consumer Economics – University of Illinois and Carl Zulauf – Department of Agricultural, Environmental and Development Economics – Ohio State University

Farmers will again have until March 15 to make commodity title program selections. Given the current high prices, commodity title payments are not expected from any program option for the 2022 marketing year. If a change in conditions resulted in payments, those would be received in October 2023, after the close of the 2022 marketing year. Farmers wishing to purchase the Supplemental Coverage Option (SCO) crop insurance policy must select Price Loss Coverage (PLC) as the commodity title choice. Based on current price projections, Agriculture Risk Coverage at the county level (ARC-CO) will maximize the chance of payment for soybeans, although that chance will be small. The probability of payments is roughly the same for corn and soybeans.

Decision Overview

Farmers have three program options when making their election decisions.

- Price Loss Coverage (PLC) is a crop-specific fixed price support program that triggers payments if the marketing year average (MYA) price falls below the commodity’s effective reference price. Payments are made on 85% of historical base acres.

- Agricultural Risk Coverage at the county level (ARC-CO) is a crop-specific county revenue program. ARC-CO triggers payments if actual revenue (MYA price times county yield) falls below 86% of the benchmark revenue (product of benchmark price and trend-adjusted historical yield for the county). Payments are made on 85% of historical base acres.

- Agricultural Risk Coverage at the individual level (ARC-IC) is a farm-level revenue support program. Like ARC-CO, payments are triggered if actual revenue falls below 86% of the benchmark. If an FSA farm unit is enrolled in ARC-IC, information for all commodities planted in 2022 are combined together in a weighted average to determine benchmark and actual revenues. If a farmer enrolls multiple FSA farms in the same state, all farm units are combined in determining the averages for actual and benchmark revenues. Payments are made on 65% of historical base acres.

Farmer and Farmland Owner Income Tax Webinar

By Clint Schroeder

This Thursday, December 9th, OSU Extension will be hosting a Farmer and Farmland Owner Income Tax Webinar from 6:30-8:30PM. The cost for this program is $35 and registration can be completed at go.osu.edu/farmertaxwebinar The featured presenters will be Michael Langemeier from Purdue University as well as David Marrison and Barry Ward from OSU Extension.

The Allen County Extension Office will also have copies of the 2021 Farmer’s Tax Guide available for pick up after December 15th.

Understanding FSA’s 2021 ARC/PLC Election and Enrollment

Producers can now make elections and enroll in the Agriculture Risk Coverage (ARC) and Price Loss Coverage (PLC) programs for the 2021 crop year. Producers can elect coverage and enroll in crop-by-crop ARC-County or PLC, or ARC-Individual for the entire farm. Although election changes for 2021 are optional, enrollment (signed contract) is required for each year of the program. The deadline to enroll and make amendments to program elections is March 15, 2021.

Join The Ohio State University Extension Service as they host a webinar to discuss the ARC/PLC decision for the 2021 program year including updates on current market outlook and decision-tool calculators available to evaluate options and deadlines.

There is no cost to attend these meetings, but registration is required. To register visit: go.osu.edu/arcplc2021

- The webinar is scheduled for Thursday, February 25, 2021 from 9:00 am – 11:00am EDT.

- For more information or to ensure your question is addressed during the webinar, please send questions to Mary Griffith, Griffith.483@osu.edu or 740-852-0975.

Farmer’s Tax Guides – Tax Guidance for Your Farm Business

By Barry Ward, Director, OSU Income Tax Schools

Do you need a resource to answer those tough farm tax questions? If so, you can access the Farmer’s Tax Guide (IRS Publication 225) online at: https://www.irs.gov/pub/irs-pdf/p225.pdf

The 2020 Farmer’s Tax Guide explains how federal tax laws apply to farming. This guide can be used as a guide for farmers to figure taxes and complete their farm tax return.

The explanations and examples in this publication reflect the Internal Revenue Service’s interpretation of tax laws enacted by Congress, Treasury regulations, and court decisions. However, the information given does not cover every situation and is not intended to replace the law or change its meaning.

Some of the new topics for the 2020 tax year which are included in this publication are: Tax treatment of Coronavirus Food Assistance Program (CFAP) payments, Payroll Protection Program (PPP) Loans and Forgiven Debt, Increased section 179 expense deduction dollar limits, COVID-19 related employment tax credits and other tax relief, Redesigned Form W-4 for 2020, New Form 1099-NEC, and much more.

Hardcopies of the 2020 Farmer’s Tax Guide are also available at select county OSU Extension offices.

The Rural Tax Education Site has additional resources for agriculturally related income and self-employment tax information that is both current and easy to understand: https://ruraltax.org/

Agricultural Risk Coverage and Price Loss Coverage for the 2021 Crop Year

The 2018 Farm Bill reauthorized the Agriculture Risk Coverage (ARC) and Price Loss Coverage (PLC) safety net programs that were in the 2014 Farm Bill. Producers must enroll in ARC/PLC for the 2021 crop year through their local Farm Service Agency office. Producers can amend the program elections they made for the 2019 and 2020 crop years for the 2021 crop year. The signup period for the 2021 crop year is open now, and the deadline to enroll and make amendments to program elections is March 15, 2021.

If changes are not made by March 15, 2021 deadline, the election defaults to the programs selected for the 2020 crop year with no penalty. Producers will have the opportunity to amend program elections again for the 2022 and 2023 crop years. Continue reading Agricultural Risk Coverage and Price Loss Coverage for the 2021 Crop Year

Continue reading Agricultural Risk Coverage and Price Loss Coverage for the 2021 Crop Year

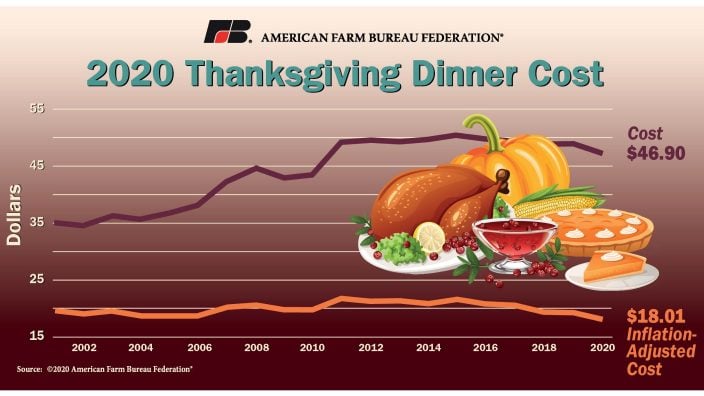

Thanksgiving dinner cost remains stable

From Ty Higgins, Ohio Farm Bureau

As many families struggle with the economic impacts of the pandemic, there is good news in this year’s Thanksgiving dinner cost survey, conducted by the American Farm Bureau Federation. The average cost of a traditional Thanksgiving dinner for 10 remains affordable for consumers, coming in at $46.90 or less than $5 per person, a decline of 4% from last year.

The 35th annual informal survey of classic food items typically found on the Thanksgiving Day table shows the average cost of this year’s Thanksgiving dinner is the lowest since 2010. The AFBF Thanksgiving dinner survey was first conducted in 1986. The informal survey provides a record of comparative holiday meal costs over the years. Farm Bureau’s classic survey menu has remained unchanged since 1986 to allow for consistent price comparisons.

Farmer and Farmland Owner Income Tax Webinar

By: Barry Ward, Director, OSU Income Tax Schools

College of Food, Agricultural and Environmental Sciences, OSU Extension

Are you getting the most from your tax return? Farmers and farmland owners who wish to increase their tax knowledge should consider attending this webinar that will address tax issues specific to this industry. Content focuses on important tax issues and will offer insight into new COVID related legislation.

Are you getting the most from your tax return? Farmers and farmland owners who wish to increase their tax knowledge should consider attending this webinar that will address tax issues specific to this industry. Content focuses on important tax issues and will offer insight into new COVID related legislation.

Mark your calendars for December 3rd, 2020 to participate in this live webinar from 6:30 to 8:30 pm. The event is a joint offering from OSU Income Tax Schools which are a part of OSU Extension and the College of Food, Agricultural and Environmental Sciences and Purdue University Income Tax Schools. If you are not able to attend the live webinar, all registered participants will receive a link to view the recorded webinar at a time of their convenience. This link will be available through the tax filing season. Continue reading Farmer and Farmland Owner Income Tax Webinar

2020 Virtual Agricultural Lender Seminar

2020 Virtual Agricultural Lender Seminar

Wednesday October 21, 2020

9:00 am—12:00 pm

Registration Is Now Open

Link: http://go.osu.edu/2020AgLenderSeminarReg

Cost $25

Topics and speakers:

Grain Prices and Farm Policy – Ben Brown, OSU AEDE

Enterprise Budgets and Returns per Acre – Barry Ward, OSU Extension

Niche/Small Farm Legal Issues – Peggy Hall, OSU Extension

Growing Customer Relationships – Rob Leads, OSU Extension

U.S. Ag & Financial Conditions – David Oppedahl, Federal Reserve Bank, Chicago

Feel free to contact OSU Extension Defiance County at 419-782-4771 or walters.269@osu.edu