Ohio Farm Numbers, Land in Farms, and Agricultural Land Lost to Development

By: Professor Ani Katchova, Farm Income Enhancement Chair and PhD students Xiaoyi Fang and Rae Ju in the Department of Agricultural, Environmental, and Development Economics (AEDE) at the Ohio State University. Click here to access the pdf version of the…

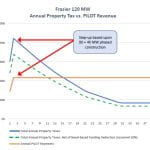

Tax revenues or PILOT II

Posted by Brent Sohngen Please feel free to email with any questions: sohngen.1@osu.edu The upshot of this post (to see the last post referred to below, go here) You can’t compare two financial analyses that use fundamentally different input data….

The Economics of Solar Development in Ohio

By Grayson Penland and Brent Sohngen This report examines a number of economic aspects of solar development in Ohio. Here is a summary of the findings. A PDF of the report can be downloaded here. Solar energy constitutes about 1.4%…

Ohio Crop Production and Enterprise Benchmarking for 2022

By: PhD student Xiaoyi Fang and Professor Ani Katchova, Farm Income Enhancement Chair, in the Department of Agricultural, Environmental, and Development Economics (AEDE), and Clint Schroeder, Farm Business Analysis Program Manager, Ohio State University Extension. Click here to access the…

Real Property Tax Versus PILOT for Solar?

by Brent Sohngen, AED Economics (Sohngen.1@osu.edu) Amid the debate about installing solar power on farmland in the state lies a discussion about how to evaluate the approach any county takes when taxing solar fields. It is well known that…

Recent Comments