By Pierce Paul, OSU Extension

Causes of Stalk Rot: Several factors may contribute to stalk rot, including extreme weather conditions, inadequate fertilization, problems with nutrient uptake, insects, and diseases. This year, the combined effects of prevalent diseases such as northern corn leaf blight, southern rust, tar spot, and gray leaf spot may negatively affect stalk quality. However, the extent of the problem will depend on when these diseases develop and how badly the upper leaves of the plant are damaged. When leaves above the ear are severely damaged well before grain-fill is complete, the plants often translocate sugars from the stalk to fill grain, causing them to become weak and predisposed to fungal infection. A number of fungal pathogens cause stalk rot, but the three most important in Ohio are Gibberella, Collectotrichum (anthracnose), and Fusarium.

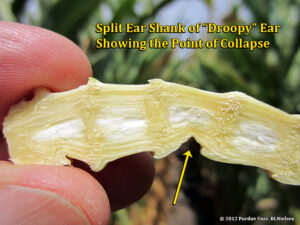

Checking for Stalk Rot: Symptom common to all stalk rots are deterioration and discoloration of the inner stalk tissues. Consequently, you can use the “squeeze test” or the “pinch test” to assess stalk rot and the potential for lodging without having to remove plants and split the stalks. Bend down and squeeze or pinch the internode of the stalk about 6-8 inches above the ground between the thumb and forefinger. If the inner node is easily compressed or collapses under pressure, you will likely have some type of stalk rot. The “push” test is another way to assess stalk rot and the risk for lodging. Gently push the stalks at the ear level, 6 to 8 inches from the vertical. If the stalk breaks between the ear and the lowest node, stalk rot is usually present. Stalk rot severity may vary from field to field and from one hybrid to another.

Consequences of Stalk Rot: Stalk rots may cause lodging, especially if the affected crop is not harvested promptly. On lodged plants, the ear on or close to the ground may develop ear rots and become contaminated with mycotoxins. In addition, lodging may lead to grain yield losses and slowdown the harvest operation. However, it is not uncommon to walk corn fields where nearly every plant is upright yet nearly every plant is also showing stalk rot symptoms. Many hybrids have excellent rind strength, which contributes to plant standability even when the internal plant tissue is rotted or beginning to rot. However, strong rinds will not prevent lodging, especially if harvest is delayed and the crop is subjected to strong winds and heavy rains. To minimize these problems, harvest promptly after physiological maturity, even if you have to do so at a slightly higher moisture content (moisture in the lower 20s).

Due to popular demand, the AgCrops Team will host the 2nd annual virtual Corn College and Soybean School on February 15, 2022, from 9:00 AM – 4:00 PM featuring your OSU Extension state specialists, including the new corn agronomist, Dr. Osler Ortez, and new soybean pathologist, Dr. Horacio Lopez-Nicora. CCA CEUs will be available during the live presentations. The cost of the program is $10. To register go to

Due to popular demand, the AgCrops Team will host the 2nd annual virtual Corn College and Soybean School on February 15, 2022, from 9:00 AM – 4:00 PM featuring your OSU Extension state specialists, including the new corn agronomist, Dr. Osler Ortez, and new soybean pathologist, Dr. Horacio Lopez-Nicora. CCA CEUs will be available during the live presentations. The cost of the program is $10. To register go to

A new suite of crop staging videos has been built by faculty at The Ohio State University that highlight corn, soybean, and alfalfa. The videos highlight some common staging methods for each crop and connect the staging guidelines to practice using live plants in the field. The videos can be found in the “Crop Growth Stages” playlist on the AgCrops YouTube Channel:

A new suite of crop staging videos has been built by faculty at The Ohio State University that highlight corn, soybean, and alfalfa. The videos highlight some common staging methods for each crop and connect the staging guidelines to practice using live plants in the field. The videos can be found in the “Crop Growth Stages” playlist on the AgCrops YouTube Channel: