by: Carl Zulauf, Professor, Ohio State University, February 2015

Also available at http://aede.osu.edu/research/crop-program-decisions

This article highlights 3 key features of the crop program decision: (1) the programs differ, (2) uncertainty abounds, and (3) long-run probabilities can differ from short-run outcomes. Implications are then drawn.

Different Programs: Both ARC (Agriculture Risk Coverage) and PLC (Price Loss Coverage) are multiple year risk programs that include U.S. crop year price in setting their risk benchmark and pay on historical base acres. On most other program attributes they differ because they focus on different risks. ARC’s focus is multiple years of shallow revenue loss, where loss is defined by market revenue of the last 5 years. PLC’s focus is multiple years of low prices, where low price is defined as a reference price Congress sets. In short, ARC and PLC will differ, often dramatically, in the timing and size of payments.

Uncertainty: As farmdoc daily articles of August 7, 2014 and February 4, 2015 document, ability to predict future price is limited. Little is known about the 2016-2018 crop years beyond long-run historical probabilities of price, revenue, and yield. Some year-specific information may exist about 2015 by the March 31, 2015 decision deadline. The acreage intension report is released on that day and winter wheat is planted. More year-specific information exists about 2014, but even it is limited as the farmdoc daily article of January 8, 2015 documents. Program choice will thus be made under considerable uncertainty. Only in October 2019 will it be known which type of risk occurs most often, i.e., what program pays the most.

Long Run Probabilities vs. Short Run Outcome: All program calculators estimate payments based on long run probabilities for price, yield, and revenue derived from observations over a historical period of time. This approach reflects the notion that a reasonable starting point for estimating the future is past experiences. However, long-run probabilities may not apply over a short period of time. Low probability events can drive actual outcomes over a short time period. For example, a 2012 style drought in the U.S. in 2016 has a low probability but will notably alter the profile of risk for the 2016-2018 crop years. This point reinforces the previous point that program choice involves considerable uncertainty.

Implications

► When managing situations with considerable uncertainty, 2 strategies emerge: (1) diversification and (2) appropriate use of factors about which more is known.

► Diversification in this article focuses on electing different programs for the same crop across FSA farms. Diversification can also involve electing different programs for different crops on the same FSA farm. Much more has been written about selecting different programs for different crops.

► More is known about 2 relationships: (1) reference price vs. recent U.S. crop year prices and (2) program vs. county vs. FSA farm yields. These relationships can help with decisions in some, not all, situations.

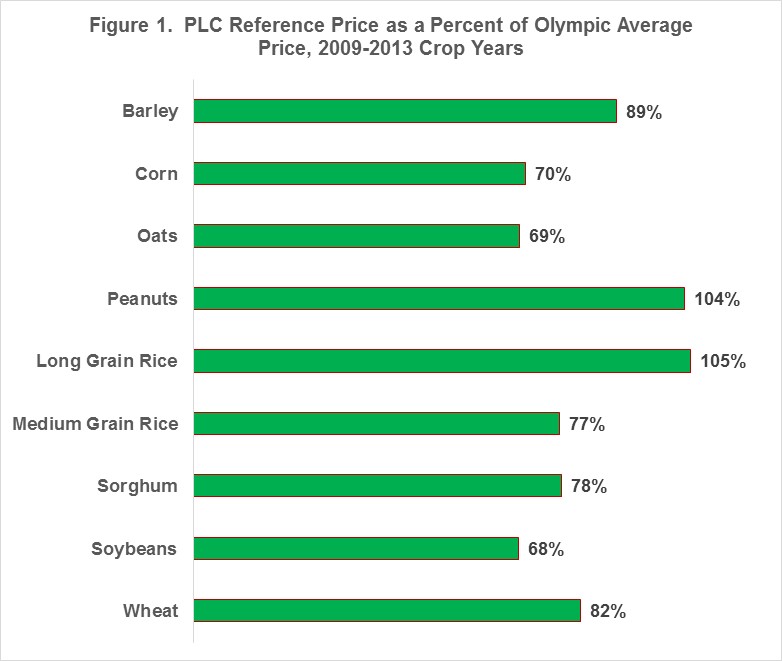

■ The ratio of reference to recent crop year price ranges from roughly 70% (corn, oats, soybeans) to roughly 105% (peanuts, long grain rice) (see Figure 1). The higher is this ratio, the more likely will PLC make higher payments. Given that 2014 is a low price year, the lower is this ratio, the more likely ARC may make a payment in some, perhaps many, situations in 2014 (see farmdoc daily article of February 5, 2015). However, diversification remains a consideration. For example, for peanuts and long grain rice, shallow losses just might emerge as their key risk factor due to drought.

■ Consider PLC for FSA farms with a high ratio of program to county yield; ARC-CO for FSA farms with a high county-to-program yield ratio; and ARC-IC for an FSA farm if yield is 30% or so above the county yield or highly variable from year to year, especially if only 1 crop is grown on the farm. A high relative yield that favors a program means that its payments are likely to be higher if the risk occurs.

► Diversification does not mean putting equal number of FSA farms in each program. The share in each program can be varied based upon personal preference, consideration of the relationship between yields and between reference price and recent crop year prices, or other factors.

► Diversification works better the more FSA farms an operator has. If FSA farms are 1 or a few, consider that ARC is actually a hybrid program because the PLC reference price is its minimum price component. Thus, ARC provides assistance against multiple year shallow losses and some assistance, but not as much as and perhaps much less than PLC, against multiple years of prices below the reference price.

► Consider using any program payments for the 2014 crop year to design a risk strategy for prices below the reference price, particularly if only ARC is elected, or for multiple year shallow losses, particularly if only PLC is elected. Such strategies can involve cash reserves, options, insurance, etc.

► Diversification will not maximize program payments. It is a strategy for managing uncertain outcomes across different risk management instruments, in this case crop programs.

► Program choice involves many factors, some unique to each situation. The decision must consider them. This article does not propose a decision; it raises factors to consider, hence the repeated use of this word.