By: Gary Schnitkey, Krista Swanson, Nick Paulson, Jonathan Coppess, Department of Agricultural and Consumer Economics University of Illinois; Carl Zulauf and Ben Brown, Department of Agricultural, Environmental and Development Economics Ohio State University

Strategies for evaluating Agricultural Risk Coverage at the Individual level (ARC-IC) are discussed in this article given that 2019 farm yields are known and can aid in making decisions. We suggest estimating 2019 ARC-IC payments for each FSA farm and then ranking them from the highest to lowest payment level. Since combined farms may not have the same payment as separate farms, we suggest evaluating combining farms beginning with the highest level and working the way down the list. This procedure focuses totally on 2019 payments and ignores 2020 payments. The decision to enroll in ARC-IC based on what is known for 2019, introduces the risk of receiving a 2019 ARC-IC payment while not getting a 2020 payment that may occur when choosing ARC at the county level (ARC-CO) or Price Loss Coverage (PLC).

Who Should Consider ARC-IC Payments?

Farmers will be able to make separate commodity title decisions on each Farm Service Agency (FSA) farm, and many FSA farms in the Midwest could receive ARC-IC payments (see farmdoc’s Farm Bill ToolBox for more detail on 2018 Farm Bill alternatives). ARC-IC payments likely will be made on the following FSA farms:

- An FSA farm that was completely prevented plant. If the entire farm is prevented plant, the maximum ARC-IC payment will be received on that FSA farm if enrolled separately. Those payments could be in the range of $40 to $50 per base acre over much of Illinois. Note that all crops on the entire FSA farm must be prevented plant. If any planting of any crops occurs, revenue from planted acres will determine ARC-IC payments. If a farm took prevented plant on corn but planted soybeans, revenue from soybean acres will determine if there is an ARC-IC payment.

- An FSA farm has lower yields. One judgment of whether ARC-IC may make a payment is whether a farm received crop insurance payments on Revenue Protection (RP) or other COMBO products. If crop insurance payments are being received, there is a good chance of ARC-IC payments. In Illinois, many farms with 180 bushel corn yields and 50 bushel soybean yields will trigger payments. Be sure to note that FSA farm may be different from insurance unit and may also be different from operational farm. Keep in mind that farm program decisions are made by FSA farm.

Special Circumstances for 2019

Farmers must make their 2019 and 2020 commodity title choices by March 15, 2020, with the same commodity title choice applying to both years. This sign-up period provides special opportunities to know more about 2019 ARC-IC payments than will exist in future years. For 2019, ARC-IC makes payments when 2019 farm revenue is below a farm guarantee (see farmdoc daily, February 4, 2020, January 7, 2020, and October 29, 2019 for more information on ARC-IC). The farm guarantee is known because it is based on farm yields and prices from 2013 through 2017. Farm revenue equals 2019 farm yields times 2019 market year average (MYA) prices. At this point, farm yields for 2019 are known. Only 2019 MYA prices are not known, but reasonable estimates of these prices are available. In February, USDA estimated 2019 MYA prices at $3.85 per bushel for corn, $8.75 per bushel for soybeans, and $4.55 per bushel for wheat. With these MYA prices, estimates of ARC-IC payments can be obtained.

Combined Payments from FSA Farms Enrolled in ARC-IC

We suggest estimating ARC-IC payments for each FSA farm and then strategically picking farms to enroll in ARC-IC that maximize 2019 payments. Note that FSA will not simply average ARC-IC payments across FSA farms. Instead, FSA will average benchmark revenue and actual revenue across all crops on all farms enrolled in ARC-IC.

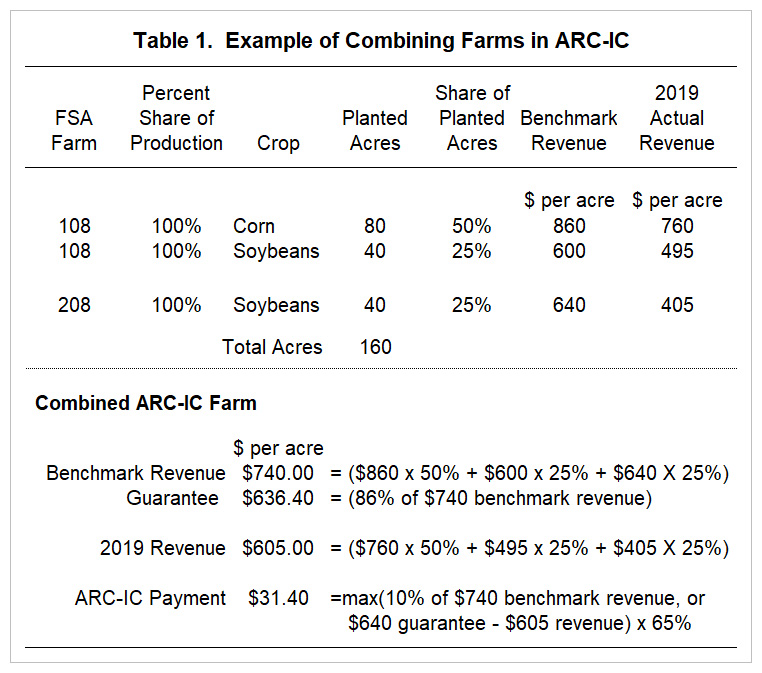

Table 1 illustrates this process for two FSA farms: 108 and 208. On both of these farms, the farmer has a 100% share of production. FSA farm 108 has 80 acres planted in corn and that corn has $860 of benchmark revenue and $760 of 2019 actual revenue. FSA farm 108 also has 40 acres of soybeans with $600 benchmark revenue and $495 of 2019 actual revenue. Farm 208 only has 40 acres of soybeans, with $640 of benchmark revenue and $405 of 2019 actual revenue. If both FSA farms 108 and 208 are enrolled in ARC-IC, and no other farms in the state are enrolled in ARC-IC, a combined benchmark revenue will be calculated. This combined revenue will be based on each crops’ benchmark revenue times the crops’ share of planted acres. There were 80 acres of corn on FSA farm 108, which represents 50% of planted acres on both ARC-IC farms. There were 40 acres of soybeans on FSA farm 108 and 40 acres of soybeans on FSA farm 2018, each representing 25% of planted acres on both ARC-IC farms. The benchmark revenue for the combined ARC-IC farm (term for all FSA farms enrolled in ARC-IC) is $740 per acre.

The ARC-IC guarantee equals 86% of benchmark revenue, or $636.40 per acre. Revenue is compared to the guarantee to see if an ARC-IC payment occurs. The $605 per acre of revenue equals the planted-crop weighted average of 2019 revenue across crops. An ARC-IC payment occurs because the $605 actual revenue is below the $636.40 guarantee. A $31.40 payment results. The $31.40 payment is the $636.40 guarantee minus $605 revenue, multiplied by 65% because ARC-IC makes payments on 65% of acres.

Two special notes need to be kept in mind because of this weighting procedure. First is the case of one FSA farm that has its ARC-IC payment that is capped at the maximum of 10% of benchmark revenue. Suppose one FSA farm enrolled separately has a $800 benchmark revenue, giving a cap on the ARC-IC payment of $80 per acre (the actual payment would be multiplied by 65% to account for base acre reductions). If this FSA farm has $500 of actual 2019 revenue, then the payment calculation would be the $688 guarantee ($800 benchmark revenue x .86) minus the $500 actual revenue, resulting in $188 which exceeds the payment cap of $80. The remaining $108 below the revenue guarantee could contribute towards a payment if it is combined with another FSA farm whose ARC-IC payment is below the cap when evaluated individually.

Second, FSA farms that are not generating ARC-IC payments will reduce ARC-IC payments if combined with farms that have ARC-IC payment, with one exception. In most cases, the amount by which benchmark revenue exceeds actual revenue on a farm triggering an ARC-IC payment is diluted by the amount actual revenue exceeds benchmark revenue on a farm not triggering payment. The exception occurs if one or more farms are at their cap of ARC-IC payments. In these cases, weighting across the farms could cause a higher payment to occur by combining farms that have capped ARC-IC payments with other farms that have no ARC-IC payments.

Strategies for Combining ARC-IC farms

The above facts suggest calculating ARC-IC payments for each FSA farm and then ranking those farms from the highest to lowest ARC-IC payment. Then, start with the FSA farm with the highest payment and combine it with the next highest payment, and evaluate whether that combination results in a higher payment. Payments may go up by combining FSA farms that have hit the maximum payment rate. Acres in FSA farms and share of production may enter into combination considerations as well. The ARC-IC tools in the 2018 Farm Bill What If Tool now identify which FSA farms are at the maximum payment. There is a beta version of an ARC-IC tool that allows ARC-IC payments to be combined across farms.

ARC-IC versus 2020 Payments

Note that this strategy identifies farms that likely will have high ARC-IC payments in 2019. The combined ARC-IC farm may not make a payment in 2020, while PLC and ARC-CO on a crop-by-crop basis may make payments.

To put this risk in perspective, a large PLC payment for corn and soybeans can be compared to the 2019 ARC-IC payment. The following uses prices that are lower than in recent years but are possible. Suppose 2020 MYA price for corn is $3.20. The PLC payment rate would be $.40 ($3.70 effective price – $3.20 MYA price) and a farm with a 190 PLC yield will generate a $64.60 payment ($.40 rate x 190 bushels per acre x 85% of base acres receive payment). Suppose the 2020 MYA price for soybeans is $8.00 per bushel resulting in a $.40 payment rate ($8.40 effective price minus $8.00 MYA price). A 50 bushel per acre PLC yield would generate $17 per acre payment ($4.00 rate x 50 bushel per acre PLC yield x .85). A farm with 60% of their acres in corn and 40% in soybeans would generate a $46 payment weighted payment in 2020. Those prices with farm yields near 2013-2017 levels would generate an ARC-IC payment near a $20 per base acre. At higher yields, ARC-IC would not generate a payment.

The above presumes that both corn and soybeans are enrolled in PLC, when ARC-CO may be the better choice, particularly for soybeans. At any rate, there are risks of taking an ARC-IC payment now and not getting a payment next year.

Summary

ARC-IC will make payments on some Midwest farms in 2019. The above strategy attempts to maximize payments in ARC-IC in 2019. Aside from unique circumstances it is not likely that ARC-IC will make payments in 2020. High ARC-IC payments in 2019 need to be weighed against the potential for 2020 payments in other programs. Of course, ARC-CO and PLC may not make payments in 2020.

At this point, our advice remains the same as before (see farmdoc daily, January 22, 2020). We suggest that farmers evaluate ARC-IC for their individual Farm Service Agency (FSA) farms. This evaluation can be done using the 2018 Farm Bill What If Tool. If ARC-IC is not expected to make payments, the following will likely hold:

- Corn: We would not expect PLC ARC-CO to make payments in 2019 (see farmdoc daily, January 22, 2020). ARC-CO could make payments in a limited number of counties in 2019, with those counties in areas of very late planting. For 2020, PLC likely has a higher chance of payment and higher expected payments, given current price levels. We suggest farmers enroll in PLC>

- Soybeans: PLC is not expected to make payments in 2019. There is a reasonable chance that ARC-CO will make payments in some counties in 2019 For 2020, the likelihood and expected level of payments are about the same between ARC-CO and PLC. We suggest that farmer consider enrolling in ARC-CO.

- Wheat: There is a near certainty of PLC payments in 2019 and a very high chance of payments in 2020. ARC-CO will make payments in many counties in 2019, but those payments likely will be lower than PLC payments. The level of a PLC yield on a farm will matter in this determination. Most farmers will find PLC to be the alternative with the highest payments.

March 15th is the deadline to complete ARC and PLC choices.

References

Schnitkey, G., C. Zulauf, R. Batts, K. Swanson, J. Coppess and N. Paulson. “ARC-IC: Payment Examples and Revised 2019 ARC-IC Payment Calculator.” farmdoc daily (10):20, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 4, 2020.

Schnitkey, G., C. Zulauf, K. Swanson, N. Paulson and J. Coppess. “Expected Payments on ARC-CO and PLC: Update of Gardner Payment ARC/PLC Payment Calculator.” farmdoc daily (10):11, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 22, 2020.

Schnitkey, G., K. Swanson, C. Zulauf, R. Batts, J. Coppess and N. Paulson. “ARC-IC in 2019: Release of a 2019 ARC-IC Payment Calculator.” farmdoc daily (10):2, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, January 7, 2020.

Zulauf, C., B. Brown, G. Schnitkey, K. Swanson, J. Coppess and N. Paulson. “The Case for Looking at the ARC-IC (ARC-Individual) Program Option.” farmdoc daily (9):203, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, October 29, 2019.