I’ve been having some (okay, a lot of) car trouble recently. Fortunately, I had sufficient savings in my emergency fund to take care of some unexpected repairs. But I’m now facing the reality of having to shop for a newer car. So this February, I’m ramping-up the savings and joining over 350,000 Americans in pledging to save for my goal.

“I pledge to save money, reduce debt, and build wealth over time. I will encourage my family and friends to do the same. I wish to reach my savings goal in order to ___________. To reach my goal, I pledge to save $ ____ for ____ months. At the end of this time I will have saved $ ____ to reach my savings goal.”

Studies show that having a plan with specific goals and improving your savings can improve your finances. Participate in America Saves Week by taking the Ohio Saves Pledge or answering the question, What are you saving for?

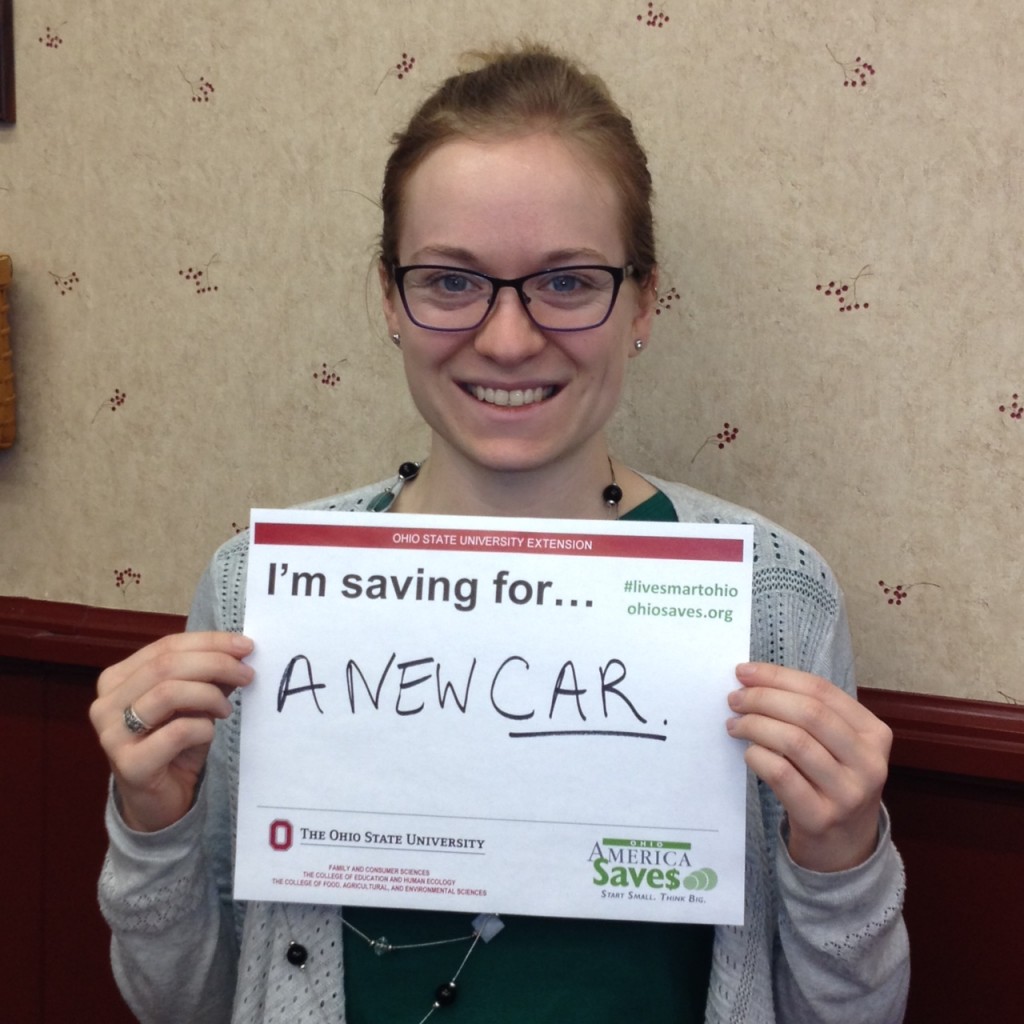

Take and share your “I’m Saving For…” picture with us! All entries will be eligible to win 2 OSU Basketball tickets for the March 1st game against Purdue or $500! Enter before February 25 in 3 easy steps:

1) Pledge to save online.

2) Take a pic with your I’m Saving For..Sign and post it on any social media with these hashtags:

#livesmartohio to win 2 Ohio State University Basketball tickets for the March 1 game against Purdue!

#imsavingfor to win $500! through the national America Saves campaign; (read eligibility)

3) Tell us you posted to be entered for prizes.